OK then, let’s get things kicked off for w fresh week’s worth of trading in the bitcoin price. Price moved a little over the weekend, with a bit of volatility here and there serving up a few entry opportunities. That said, we didn’t really see any sustained momentum, so the trades were just scalps, at best.

We should have a pretty busy week ahead if things carry through from the end of last week, so let’s get some levels in place and see where things land.

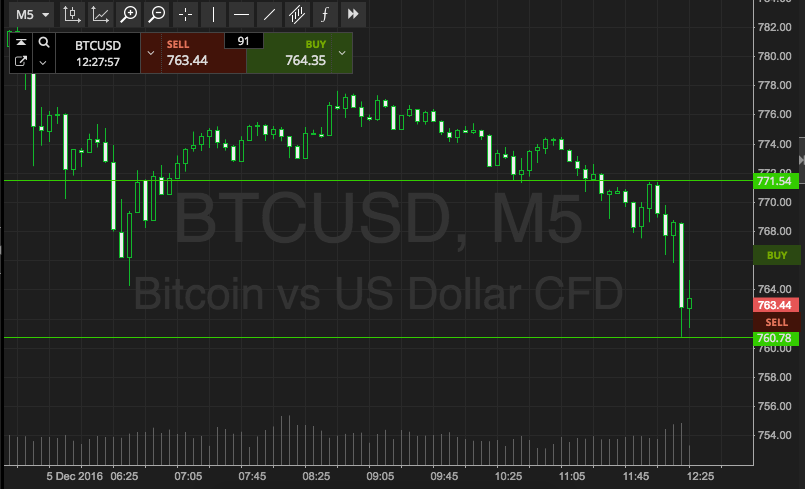

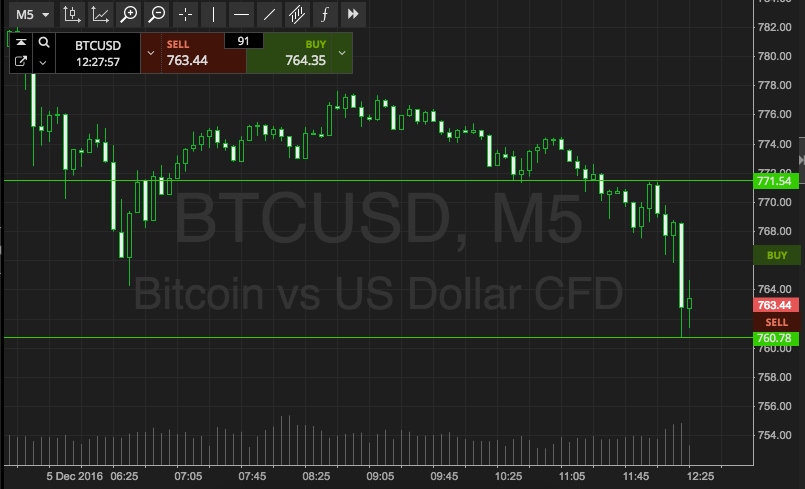

As ever, take a look at the chart below to get an idea of where things stand, and to see what happened over the last twelve hours or so.

As the chart shows, the levels we are looking at are in term support to the downside at 760, and in term resistance to the upside at 771.

There’s not really enough room to go at things with an intrarange strategy today, so we’ll be sticking with breakouts for the time being. Specifically, if price closes above resistance, we will get in long towards an immediate upside target of 778. A stop loss on the position somewhere in the region of 769 will ensure that we are taken out of the trade in the event that price reverses and trades against our position.

Looking the other way, if price breaks below support, we’re going to watch for a close below that level to get put us in short towards 753. Again we need a stop loss on this one, and we’re looking at somewhere around 763.

As a closing note to today’s morning analysis, price has shifted away from 800 over the weekend, but we’ll be keeping a close eye on any breaks towards that level early week. There’s a good chance of a hit if price can pick up a bit of momentum on a break, and we’ll be ready if and when it does.

Charts courtesy of SimpleFX