Okay then, the end of the week is here, and it’s time to put forward the penultimate of our twice-daily bitcoin price watch analyses for the week. Things have been pretty on and off this week. We have had periods of strong volatility, during which we have been able to get in and out of the markets according to our strategy rules for a few decent profits, but we have also had some relatively flat periods, whereby price has traded sideways and not really given us much to go at from a trading perspective. Let’s hope we can get a solid close to the week, and end net-positive on the markets going into the weekend.

So, as we head into the European morning session, here is our take on what happened overnight, and where we are looking to get in and out the markets according to our intraday strategy for the first half of today’s session.

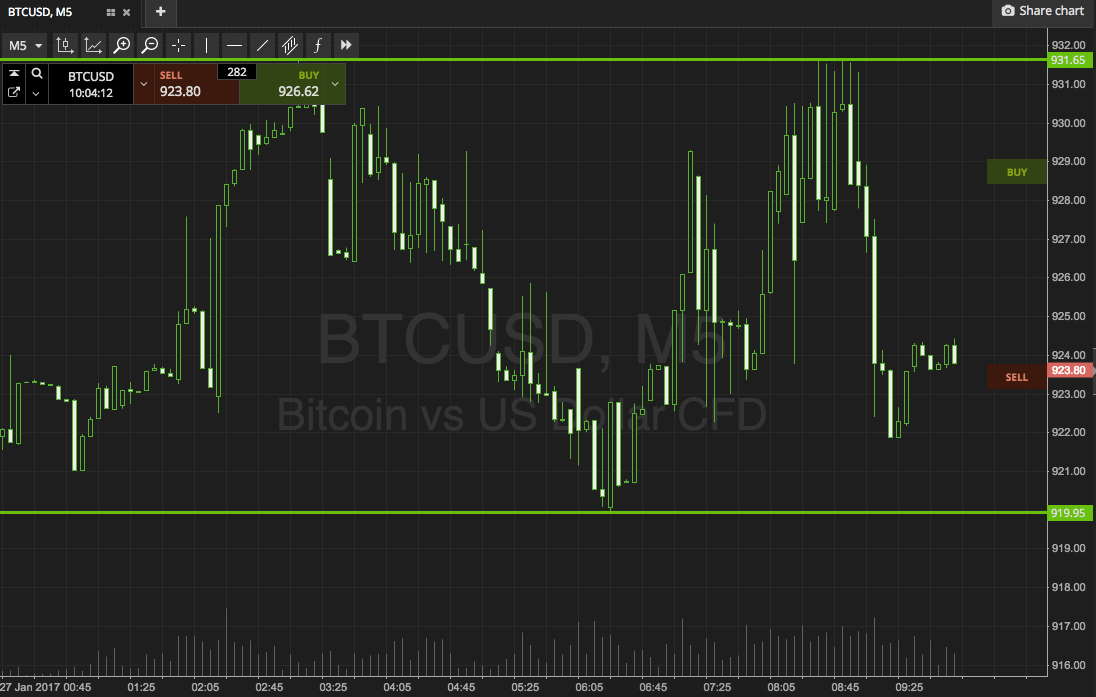

As ever, take a quick look at the chart below to get an idea of what is on.

As the chart shows, we are widening out our range for this morning, focusing on support to the downside at 919, and resistance to the upside at 931. There is probably just enough room to go at price with an intrarange approach on this one, but we are not going to bother today. With action throughout the week being pretty choppy, we’re going to stick to our breakout strategy, and only get in on what look to be the most solid entries.

So, if we see a break above resistance, we will watch closely for a close above that level, and get in longer towards an immediate upside target of 940 on said close.

Conversely, if price closes below support, it will signal a short entry towards 905 to the downside.

Stops on both trades will ensure we are taken out of the position in the event of a bias reversal.

Charts courtesy of SimpleFX