So we have come to the end of the week in our bitcoin price trading efforts and what a week we have had. Things really haven’t stopped moving from start to finish and, on the back of the action we have seen, we’ve had plenty of opportunities to really take advantage of some strong volatility in the markets. This coming period is likely to be a little bit slower than we have seen today, based purely on the fact that volume will probably be a little bit muted with the US heading into the weekend subsequent to the Thanksgiving break.

With that said, however, and especially as Asia wakes up for the weekend on Saturday morning, any volume dip will be quickly mitigated and we should start to see things pick up into mid-Saturday daytime and, beyond, into the Sunday session (which is often a big one on the back of increased Asian participation.

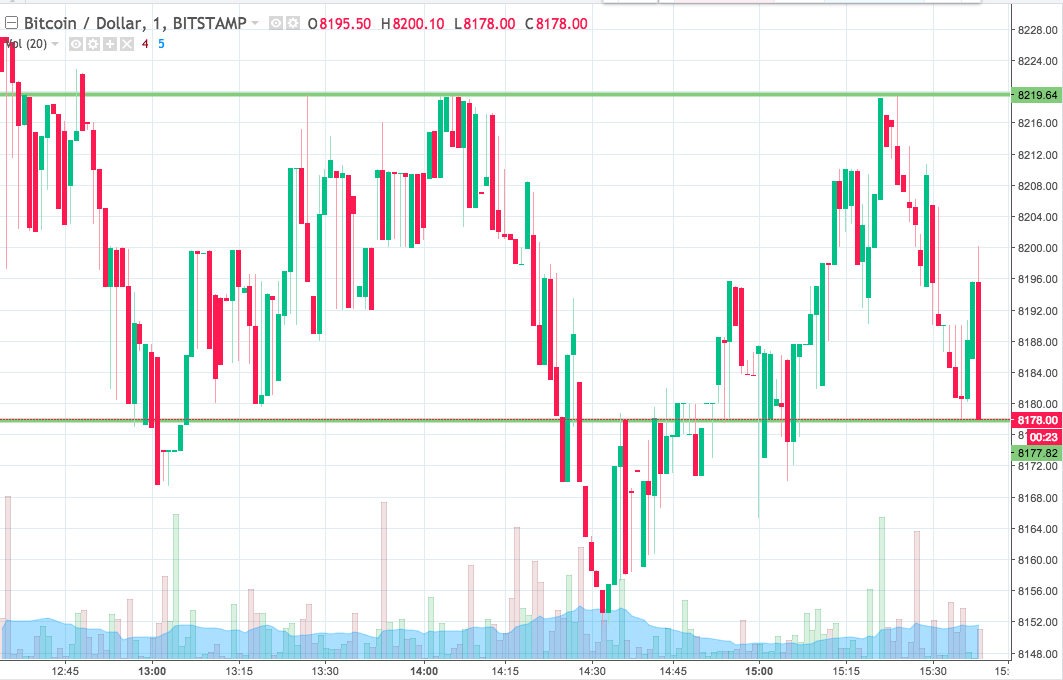

With this in mind, then, let’s get some levels in place that we can use in an attempt to carve out a profit from any volatility in the markets near term. As ever, take a quick look at the charts below before we get started so as to get an idea where things stand. The chart is a one-minute candlestick chart and it has our range overlaid in green.

As the chart shows, the range we are looking out for the session this evening comes in as defined by support to the downside at 8177 and resistance to the upside at 8219.

Standard breakout rules apply for the session, so we will look to jump into a long entry towards an immediate upside target of 8260 if we get a close above resistance and, conversely, we will enter short towards a downside target of 8120 if price closes below support.

Charts courtesy of Trading View