So we have come to the end of the week already and from a bitcoin price perspective, it’s been a pretty wild ride. What started off as a couple of days’ worth of flat action transformed into some real breakout volatility and we were able to jump on the bandwagon and ride out price for some pretty decent profits mid to late week. We are looking almost certain to end the week on a net profit and – assuming nothing goes terribly wrong today – by the time this session closes that will be confirmed.

Obviously, we have to make sure we keep our risk management principles in play so as to ensure that we don’t get caught on the wrong end of something irretrievable, but that’s the only tricky part for now.

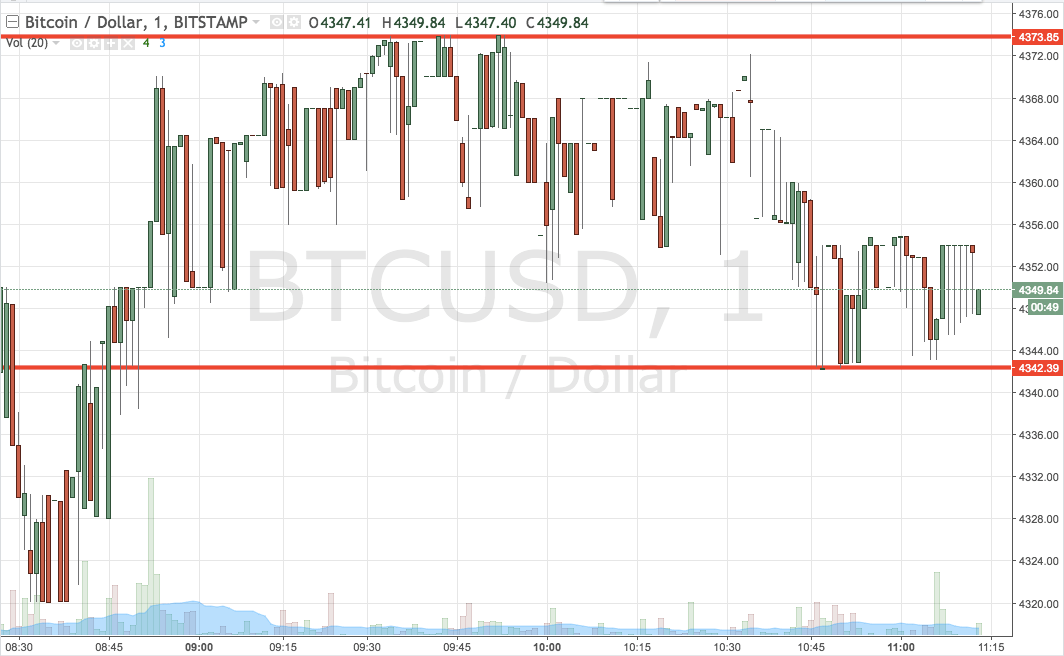

So, with this said, let’s get things in place for the session today. As ever, take a quick look at the chart below before we get started so as to get an idea of where things stand. It is a one-minute candlestick charts and it has our key range overlaid in red.

As the chart shows, the range that we have in our crosshairs for the session today comes in as defined by support to the downside at 4342 and resistance to the upside at 4374. Standard breakout rules apply for the session, at least until things calm down again. With this in mind, we will look to enter a long trade on a close above resistance towards an immediate upside target of 4400. A stop loss on the position somewhere in the region of 4364 will ensure that we are taken out the trade in the event of a bias reversal. Looking the other way, if we see price close below support, we will jump into the markets for a short trade towards a downside target of 4310. A stop loss on this one at 4350 looks good.

Chart courtesy of Trading View