Markets are about to draw to a close in Europe for this Tuesday session, and it is time to conduct the second of our twice daily bitcoin price market analyses. Action today has been pretty much in line with what we expected, and hasn’t really offered up too much insight into how things might play out this evening, as the US afternoon draws to a close and the Asian session kicks off.

So, with this said, and as we head into a fresh night’s trading in the bitcoin price, where are we looking to get in and out of the markets according to our intraday strategy, and where will we place our risk management parameters and targets to ensure that we stay on the right side of the risk reward profile on any entries? As ever, take a quick look at the chart below to get an idea of the levels in focus.

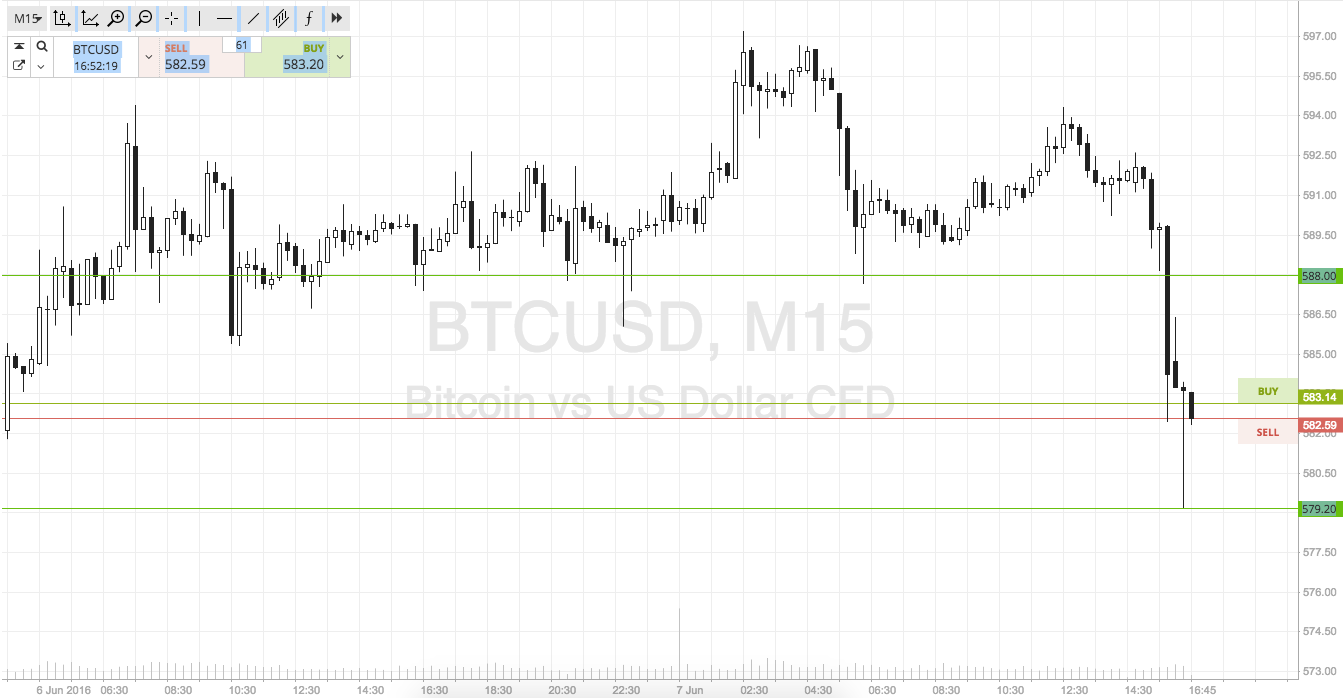

As the chart shows, the levels we are looking for in this evening’s trading are defined by in term support at 579 and resistance at 588 to the upside. It’s a little tighter than this morning, but an intrarange strategy is still valid for the more aggressive trader. Long at support and short at resistance, you know the rest.

From a breakout perspective, a close above resistance will signal a long entry towards an upside target of 595, and a stop loss on this one somewhere in the region of 586 defines risk.

On the short side of things, if price breaks below in term support, we will enter to the downside with an initial downside target of 574 and a stop loss just the other side of our entry (somewhere around 581) to ensure that we are taken out of the trade in the event that price reverses and trades back within our predefined range, post-entry.

Charts courtesy of SimpleFX