Here we go then – another day of trading in the bitcoin price and, yet again, we’ve had a pretty big night of movement. When we left the late European session yesterday evening price was hovering in and around the 2600 mark. We’d managed to get in and out of the markets on a few occasions throughout the day and drew a decent profit from action before the day closed out.

Here’s a secret – it’s really not that difficult to profit from these sorts of market conditions. When price is just rising and correcting, it’s all about getting in on the corrections and holding on to at or near the top. In other conditions, finding these points is difficult. In these conditions, it’s not that hard. So long as the key levels are tight enough to offer room to accommodate a correction, yet still wide enough to give us a chance to take advantage of a price turnaround, we’re golden.

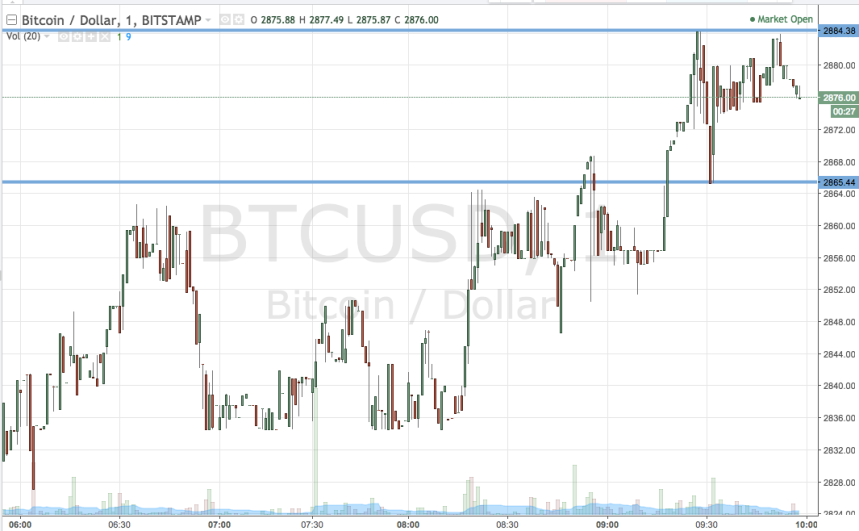

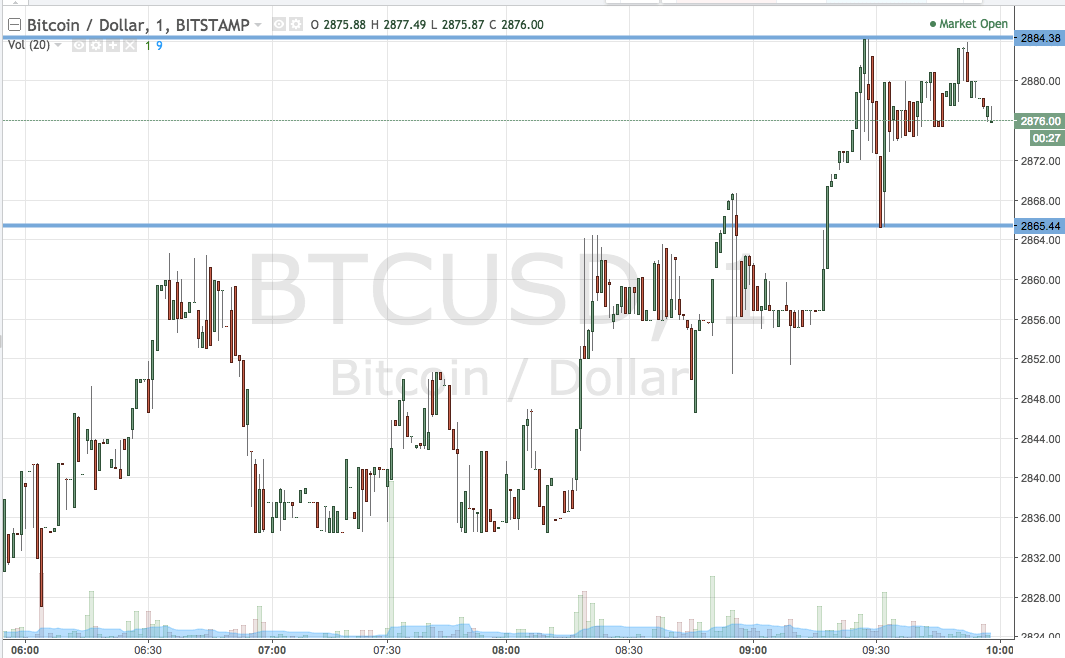

So, with that noted, let’s get to the details of how we are going to approach the session today. As ever, get a quick look at the chart below to get an idea what’s on before we get moving. It’s a five-minute candlestick chart and it’s got our key range overlaid in green.

As the chart shows, then, the range we are looking at for the early European session today is defined by support to the downside at 2865 and resistance to the upside at 2884. Standard breakout rules apply for the session, so we’ll look at getting into a long trade on a close above resistance towards an immediate target of 2900. A stop at 2880 looks good from a risk management perspective.

Looking short, a close below support will have us in towards a downside target of 2850. A stop at 2870 should work well.

Charts courtesy of Trading View