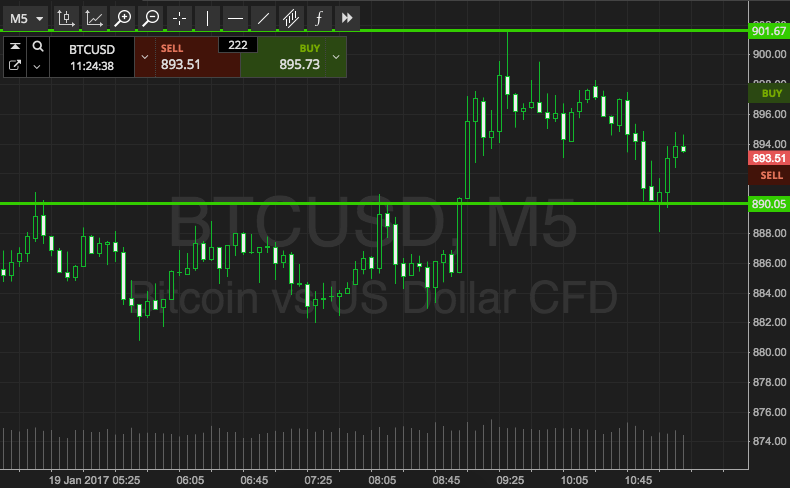

Well, the end of the week is here, and for this author at least, it seems to have gone pretty quickly. We have had plenty of action in the bitcoin price across the markets, both from an intrarange and a breakout perspective, and this has translated to numerous entry opportunities. Some of these entries have worked out well, some not so much, but we’re going to end up net profitable on the week so long as today doesn’t turn out too badly, so that’s always a win in our books. We aren’t going to ramble too much this morning, since the European session is already underway, and there is plenty happening right now in the markets. So, with this in mind, and as we move forward into today’s session, here is what we’re focusing on right now. As ever, take a quick look at the chart before we get started. It is a five-minute candlestick chart, and it has the last 12 or so hours worth of action displayed.

As the chart shows, the range we are targeting this morning is defined by support to the downside at 880, and resistance to the upside at 894. There is probably just enough room to go at price intrarange here, so, long on a bounce from support, and short on a correction from resistance. A stop just the other side of the entry on both trades will define risk.

Looking at our breakout strategy, if price breaks above resistance, we are going to look to get in long towards an immediate upside target of 910. A stop loss on the trade at 890 defines risk nicely. Conversely, and looking short, a close below support will put us into a downside trade towards an immediate target of 870. Again we need a stop loss on this one, and somewhere in the region of 885 looks good.

Charts courtesy of SimpleFX