So that’s it – the end of the week is here. On this side of the screen, the week has gone incredibly fast. Things have gone a bit slow prior to this week, probably because of the sideways action seen in the bitcoin price and the lack of any real entries that this has afforded us. This week has been a bit different, and as such, it’s been a bit of a whirlwind week.

Those familiar with our intraday strategy will be more than familiar with the way we operate. Short term scalp entries on breakouts (primarily, especially on these lower time frames) with predefined stops and take profits to allow us to set and forget our trades. This is an effective strategy when there’s volume to back up the momentum – in other words, sustainability of directional bias. When there’s not, however, it can get a little tedious.

Well, this week, with the summer coming to a close, volume looks to have picked up and the markets are moving once more. We’ve managed to get in and out on numerous occasions, and we are heading into the close of the week on what looks almost certain to be a net gain on the market – assuming we keep our risk profile tight for today’s efforts.

So, with that out of the way, let’s get to what’s important. Where are we looking to get in and out of the markets according to our intraday strategy today?

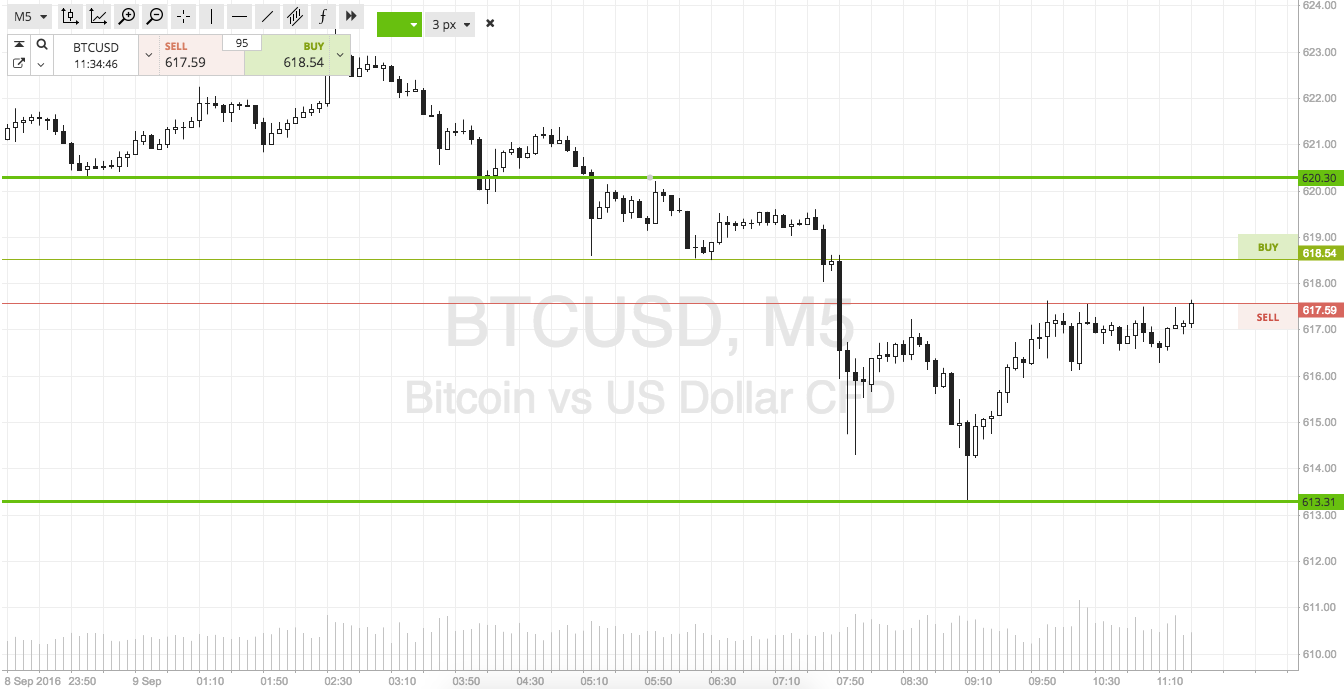

As ever, take a quick look at the chart below to get an idea of what’s on.

As the chart shows, we are focusing on in term support to the downside at 613 flat, and in term resistance to the upside at 620.

If price breaks above resistance, we will look to get in long towards 638 flat. Conversely, f price closes below support, we will get in shot towards 605. Stops just the other side of the entries to define risk.

Happy Trading!

Charts courtesy of SimpleFX