Another day, another run in the bitcoin price. Things didn’t move as much as we might have liked during the session today, and it’s looking like we’re going to head into this evening’s session out of Europe in a similar position to that which we started it. No worries – we’ll just shift our range a little to accommodate the action we saw today, and go after similar (distance-wise) risk management and reward parameters.

We did manage to get in today, but we were chopped out relatively quickly. Our risk was tight, so the chop-out wasn’t too much of an issue. That’s why we’ve got our stop losses in place, after all!

So, let’s take a look at the charts and see if we can’t outline some positive levels going forward – levels that are going to get us a profit out of the market as things mature this evening.

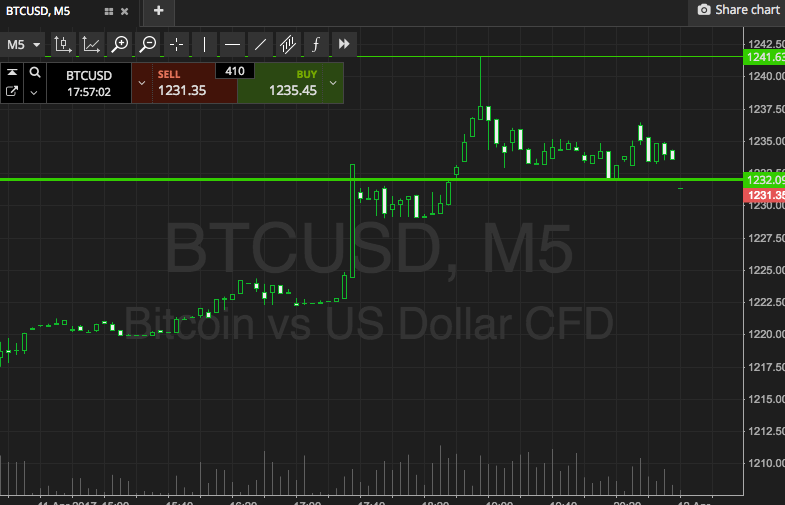

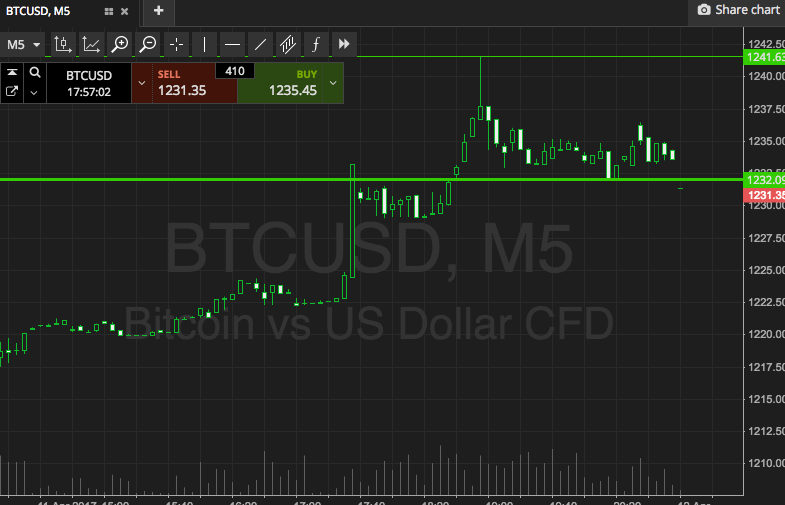

As ever, take a quick look at the chart below to get an idea what’s on before we get moving. It’s a five-minute candlestick chart and it’s got our key range overlaid in green.

As the chart shows, then, the range in focus for the session this evening is defined by support to the downside at 1232, and resistance to the upside at 1241. Standard breakout strategy for the session, but if price allows, we’ll also bring intrarange into play. So, if we see a close above resistance, we’ll be in long towards 1255. A close below support will get us in towards 1220. Stops just the other side of the entries on both trades will ensure we are taken out of the positions in the event of a bias reversal.

Looking at intrarange, long on a bounce from support and short on a correction from resistance.

Let’s see how things play out.

Charts courtesy of SimpleFX