Things are really picking up now. Price was hovering around the early 800s this morning, but throughout the European session, has gained considerably, and we’re now looking at the 850 mark as a potential near term target. Who would have predicted that? Not us. Well, not this soon, anyway. Of course, our long term view is supportive of this bullish action. Long term holdings benefit from the momentum, and all’s well there. However, as mentioned a couple of times over the last few days, we expected the Christmas holidays to have a suppressive effect on volume. No such effect is coming about.

Anyway, it doesn’t matter. We’re up heading into the second half of the week, and we’re looking good for a holiday profit. Right, time to stop rambling. This is the final coverage from me before the festive celebrations begin, but our strategy will remain in place as the wider financial markets shut down.

So, with this in mind, let’s take a look at what’s happened today, and try to figure out where we can get in and out tonight to maximize our chances of pulling a profit out of the market.

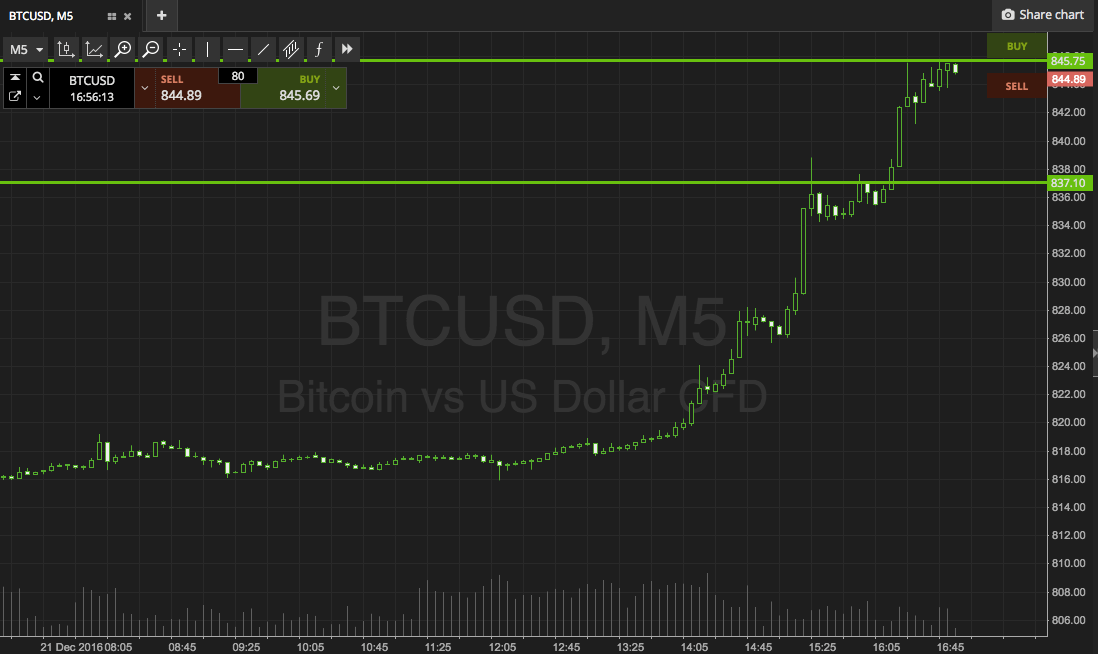

Take a look at the chart below to get an idea of what’s on.

So, as the chart shows, we are looking at support to the downside at 837 flat, and resistance to the upside at 845. We’ve mentioned it’s a tight range, and this means we won’t be going after price intrarange; instead we’ll be focusing on breakout near term.

If price closes above resistance, we will look to get in long towards an immediate upside target of 852 flat. A stop on the trade at 842 looks good.

Looking south, if price closes below support, we will get in short towards 830 flat. A stop on this one at 840 works well.

Charts courtesy of SimpleFX