If you are looking for a fast-paced and frequent entry trading strategy in the bitcoin price, you are in the wrong place. Well, that is not entirely accurate. You are in the right place, just at the wrong time. The bitcoin price has basically settled into a period of sideways momentum trading over the last few days, and – given that we are coming off the back of a pretty big fundamental development, and a downside one of that – chances are this consolidation will continue as we head into the close of this week. There is an outside chance, of course, that a flood of volume will bring with it some added volatility, but we are not banking on it. Instead, we’re just going to move forward gradually with tight ranges, and try and get in and out of the market using our intraday strategy for quick and easy profits. Anything else would be overambitious, given the current trading environment.

So, with this in mind, let’s get some levels outlined for this evening, and continue to edge forward with our efforts.

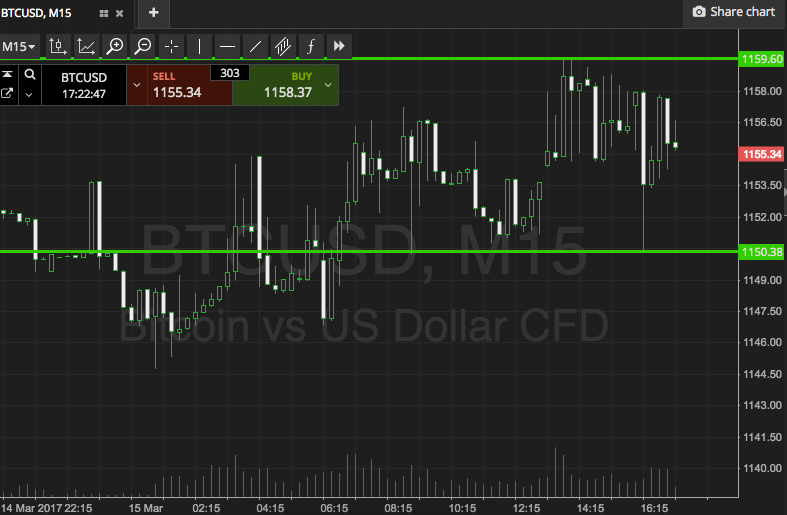

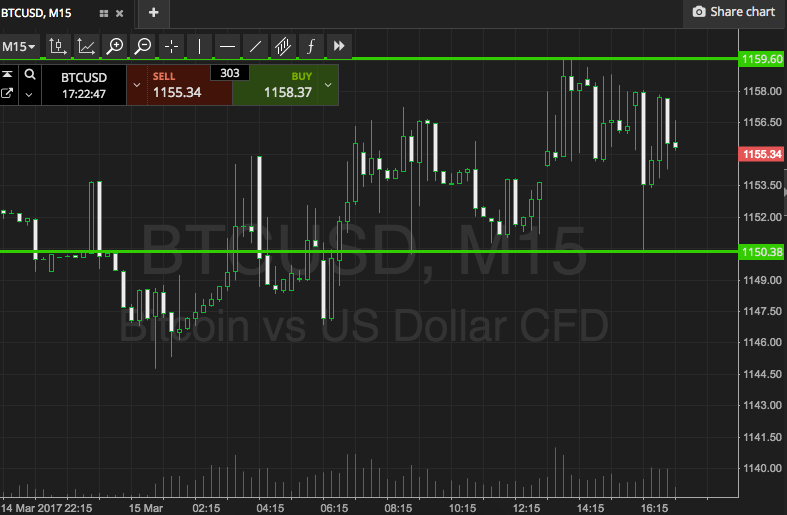

As ever, take a look at the chart below to get an idea of what is on. It is a five-minute candlestick chart, and it has our key range overlaid in green.

As the chart shows, the range we are looking at this evening is defined by support to the downside at 1150, and resistance to the upside at 1159. An upside break will put us in long towards 1167. Tight range, tight targets. A stop loss at 1154 defines risk. Conversely, a close below support will get us in short towards an immediate downside target of 1142. Again we need a stop loss, and somewhere in the region of 1153 keeps things tight, while also giving us just about enough room to avoid a chop out if price reverses temporarily.

Charts courtesy of SimpleFX