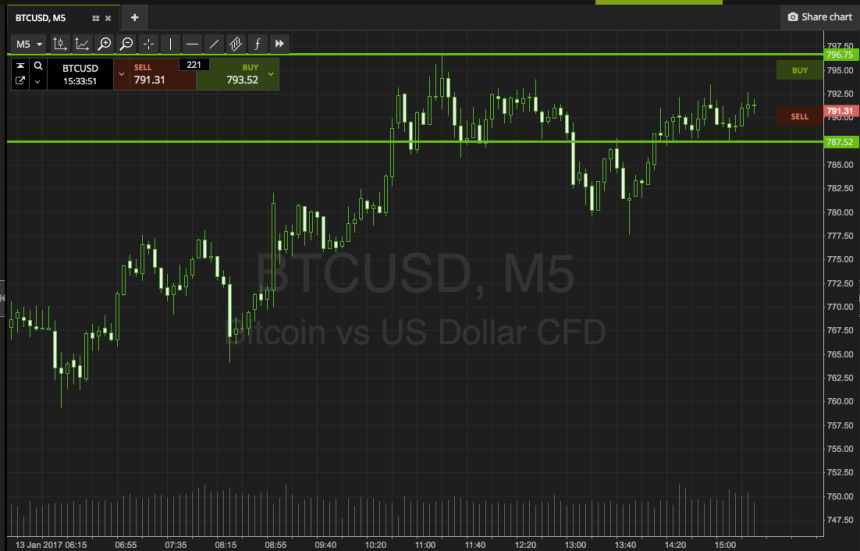

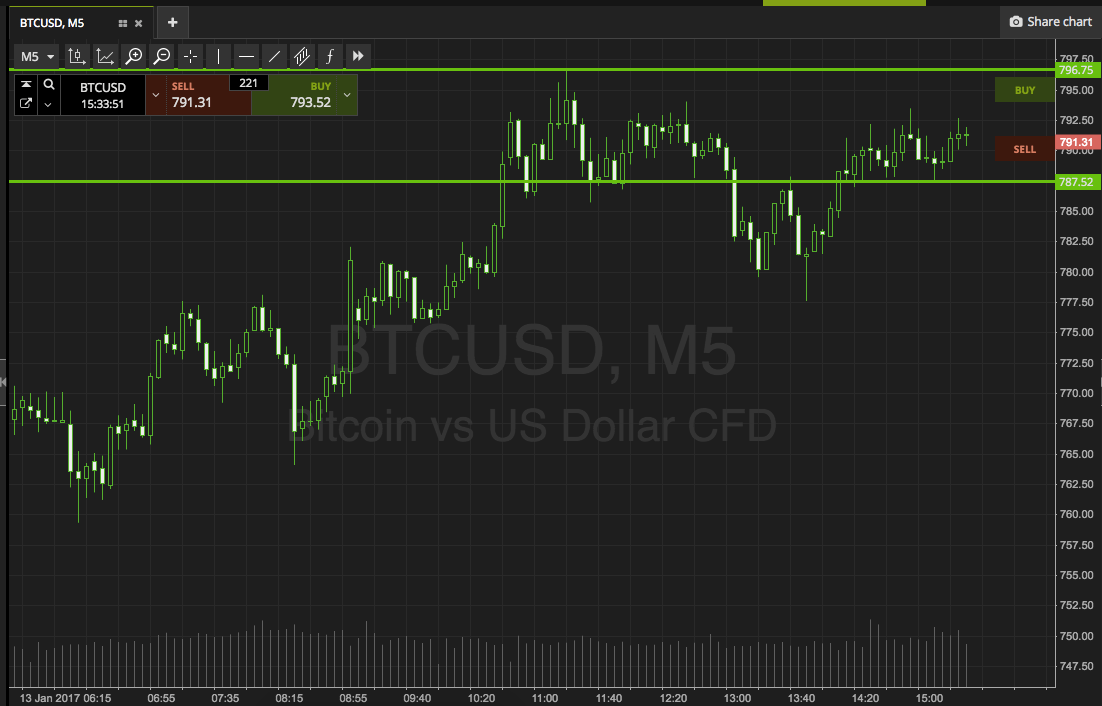

In this morning’s analysis, our primary focus was the finding of long-term support in the bitcoin price. We pointed out that it looked as though price had finally found some support, and that the upside we saw throughout yesterday afternoon, and the subsequent action in overnight trading, reinforced this thesis. We can’t be certain, of course, but it certainly looks that way. Our overarching bias, therefore, this morning, was to the upside. We didn’t really alter our strategy to reflect this bias (it’s not really necessary when it comes to intraday trading), but we did allow it to somewhat influence our risk management placement. Action has now matured throughout the European morning and early afternoon, and we are about to head into the evening session out of Europe (and concurrently, the beginning of the US lunch time trading period). This generally brings with it some degree of volatility, and so ahead of this volatility hitting the tape, let’s outline some levels with which we can move forward this evening in an attempt to draw a secondary profit from the bitcoin price. As ever, take a quick look at the chart below to get an idea of the levels in focus, and where we intend to get in and out of the markets if we see any volatility.

As the chart shows, the range we are targeting this evening is defined by support to the downside at 787, and resistance to the upside at 796. Breakout only once again. If we see price break above resistance, we’re going to look to get in long towards an immediate upside target of 807. A stop loss on the trade at 793 defines risk. Conversely, a close below support will signal short towards 780. Again we need a stop loss, and somewhere in the region of 790 looks good.

Charts courtesy of SimpleFX