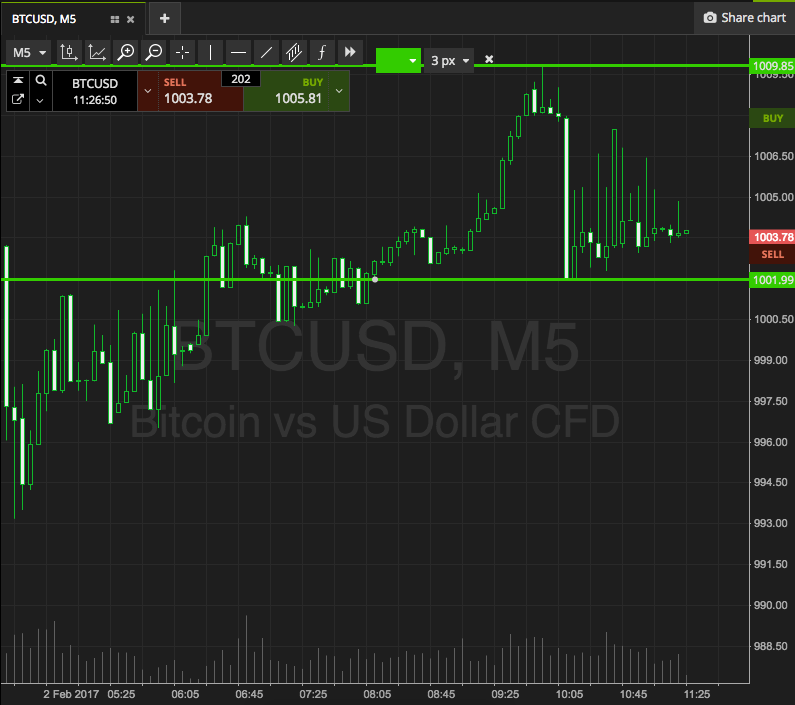

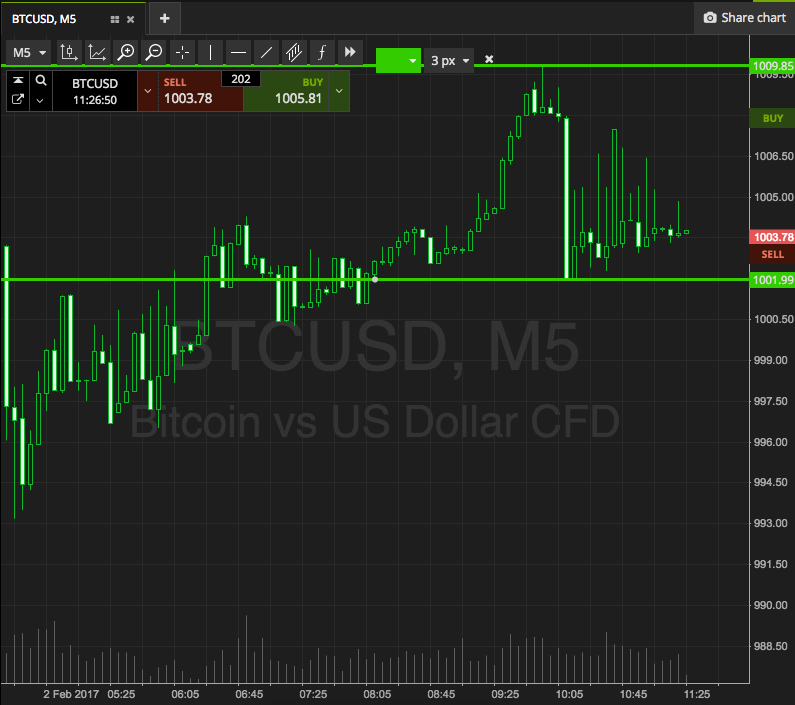

In last night’s analysis, we focused on the momentum seen in the bitcoin price throughout the day, and – in turn – the potential for price reaching (and with any luck) breaking through the 1000 level. It was early morning that we first noted it, but then as price matured throughout the day, it became a focus level. Overnight last night, price did eventually break through, and we now trade ahead of this level heading into the morning session out of Europe. So, as we move into today’s session, here is a look at what we’re focusing on in the bitcoin price, and where we will look to get in and out of the markets according to our intraday strategy. As ever, take a look at the chart below before we get started. It is a five-minute candlestick chart, and it has our range in focus overlaid in green.

The chart shows action overnight, and illustrates the breaking of the 1000 level nicely. We currently trade just ahead of this key psychological level, somewhere in the region of 1003, and this gives us a pretty solid range to go at, as defined by overnight highs, and the key level we’ve already discussed. Specifically, we’re focusing on a range defined by support to the downside 1000 and resistance to the upside at 1010. We’re going to focus on price with a breakout strategy only this morning.

So, if we see price break above resistance, we will get in long towards an immediate upside target of 1020. Conversely, a close below support will put us short towards 990. On the first trade, a stop loss at 997 works well from a risk management perspective. Looking at the second entry, if we enter short, a stop loss at 1003 looks good.

Let’s see how things play out this morning, and later we will adapt our strategy to accommodate any volatility.

Charts courtesy of SimpleFX