Yesterday evening, it was all about the break to the downside of the 1200 mark in the bitcoin price, and where that left us from an overarching trend perspective. Basically, our thesis was this: price should hold in and around current levels, as there looks to be a decent amount of support type friction between 1100-200. Price overnight sort of went against this thesis (but didn’t negate it) and we’re now trading a little bit lower than we were at the close of the European session on Monday. Our long term view remains the same – we expect price to maintain current levels, and resume its overarching upside momentum at some point over the coming few sessions.

This doesn’t change our approach, of course. Sure, we’ve got an upside bias, but we’ve still got plans to trade up and down the market – that’s what our intraday strategy is all about.

We may be a little more aggressive to the upside if price allows (if we see an upside break) but we’re more than willing to get in short for a quick turnaround trade if that’s the opportunity that comes our way.

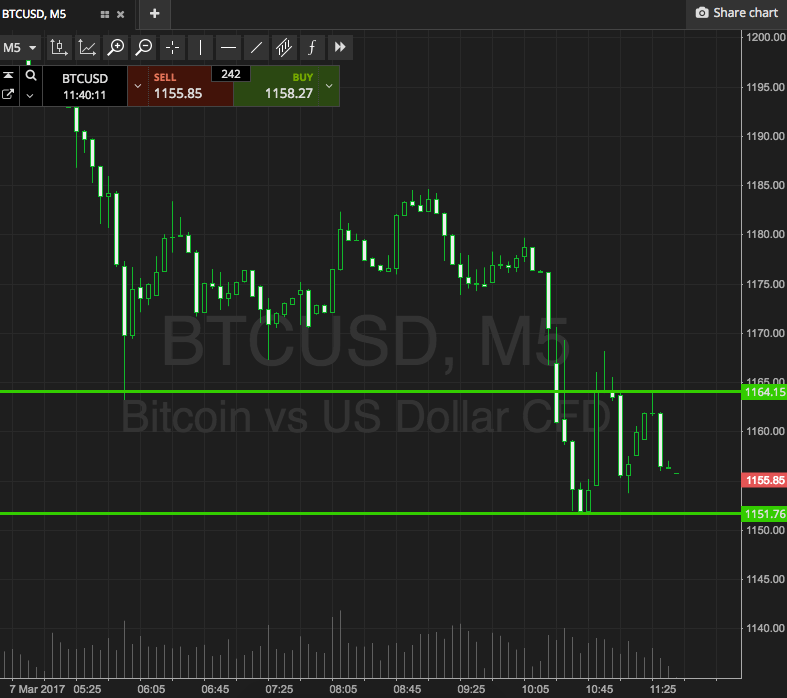

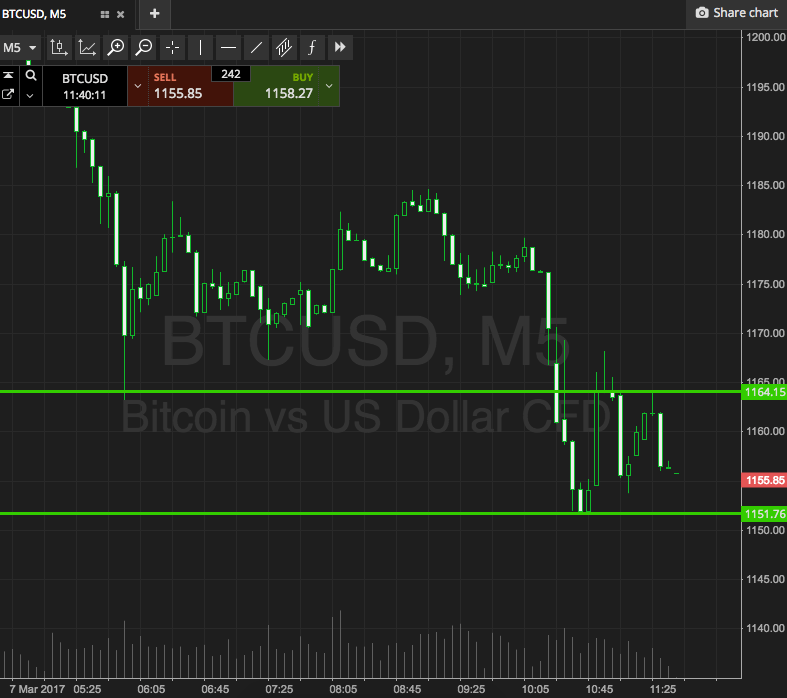

So, let’s get to it. Here are the levels we are focusing on this morning, and where we are looking to get in and out of the markets according to our intraday strategy. Take a quick look at the chart below to get an idea what’s on, and where things stand after the overnight session.

As the chart shows, our range for this evening is defined by support to the downside at 1151, and resistance to the upside at 1164. If we see a break to the upside, we’ll look to get in a long position towards 1180. A close below support will signal short towards 1141. Stops on both trades will ensure we are taken out of the position in the event of a bias reversal.

Charts courtesy of SimpleFX