It’s Monday morning, and we are about to kick off a fresh session out of Europe. Action over the weekend in the bitcoin price – as is becoming the norm – gave us plenty to discuss, and we’ll be using some of the key levels to carry forward into today’s strategy. Things were a little slow last week and on more than one occasion we had to bring our scalp strategy into play, with a narrowing of our standard range, and a short, sharp breakout approach for a few dollars here and there.

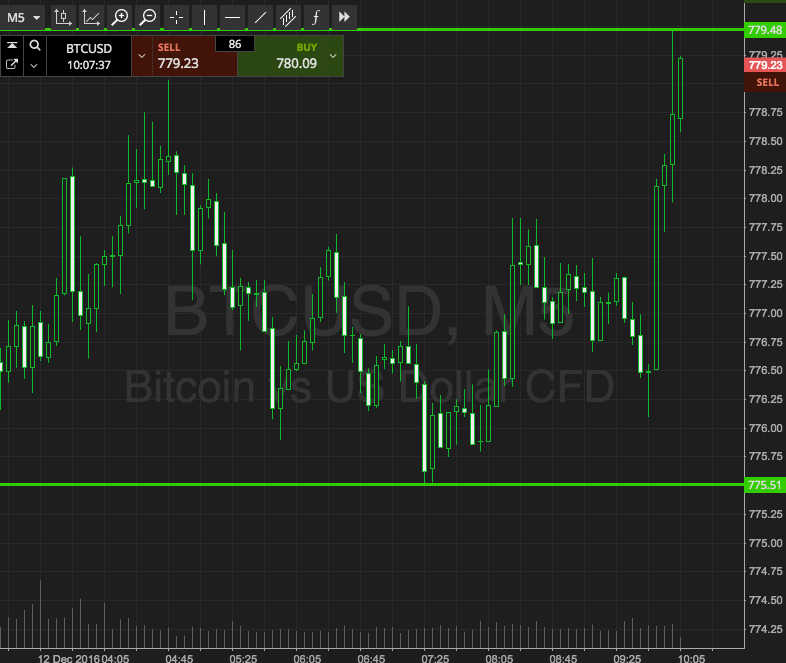

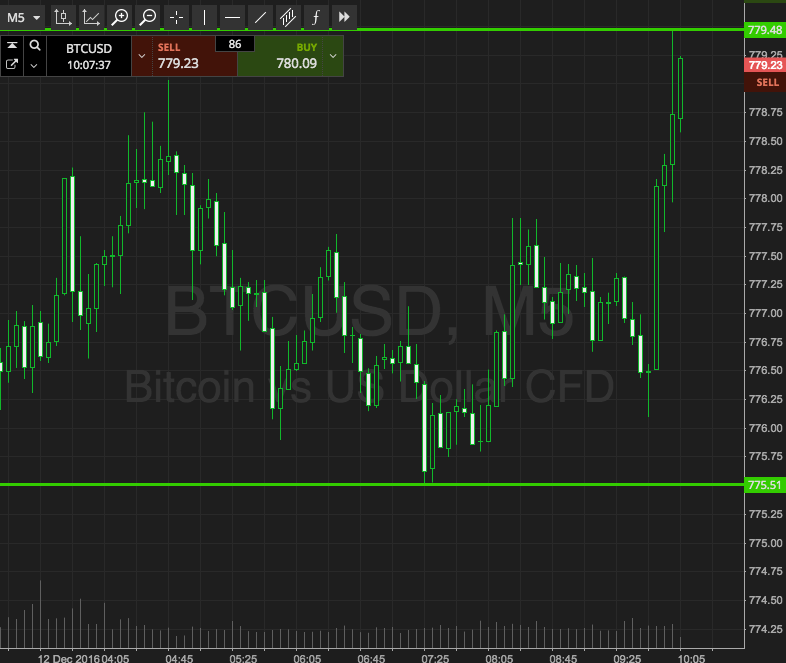

So, with this said, and as we head into today’s fresh session, here’s what we are focusing on in the bitcoin price, and a look at how we intend to approach the markets this morning. As ever take a quick look at the chart below to get an idea of the key levels for this Monday morning session.

As the chart shows, the range we are looking at for today is defined by support to the downside at 775 and, to the upside, resistance comes in at 779. It’s probably a little too tight to attempt an intrarange strategy, but for those looking for an aggressive entry, long at support on a bounce and short at resistance on a correction is a valid opportunity if volume picks up. On these trades, a stop loss just the other side of the key level entry will ensure the positions become nullified if sentiment reverses.

Looking at things from a breakout perspective, a close above resistance will signal a long entry towards an initial upside target of 786. Conversely, a short entry will signal if price closes below 775. A target on this latter position at 767 looks good. Just as with the intrarange trades, a stop loss one or two dollars the other side of the entry keeps things tight from a risk management perspective.

Charts courtesy of SimpleFX