And we are off on a fresh week of trading in the bitcoin price and – with any luck – we’ll get another good one moving forward. Things were a little bit volatile over the weekend, as brought about by some activity in the Ethereum space. The impact on bitcoin long term of what happened over at camp ETH is minimal but – as ever in this sort of asset market – nothing goes ignored as far as collateral impact is concerned.

With this in mind, we’re looking at a slightly depressed bitcoin price as things stand, with the currency trading at levels just shy of the 2500 mark heading into the start of the European session on Monday.

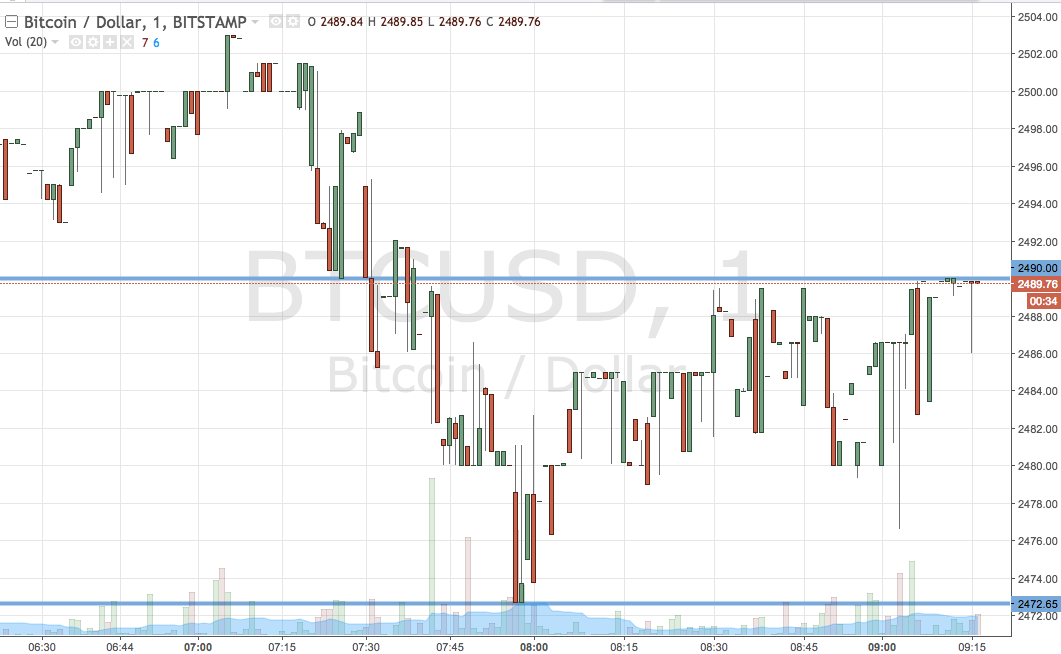

We’re looking for something of a recovery throughout the session today, so, let’s get some levels sorted out with which we can take advantage of any volatility as and when said recovery materializes. As ever, take a quick look at the chart below before we get started so as to get an idea of where things stand at the moment and what happened overnight. It’s a one-minute candlestick chart and it’s got our key range overlaid in green.

As the chart shows, the range we are looking at for the session this morning is defined by support to the downside at 2472 and resistance to the upside at 2490. We’re going to stick with our breakout strategy, for the time being, so we’ll look at getting in to a long trade on a close above resistance towards an immediate upside target of 2530. A stop on the trade at 2480 defines risk nicely.

Looking the other way, a close below support will have us in short towards 2450. A stop on this one at 2490 looks good from a risk management perspective.

Let’s see how things play out.

Charts courtesy of Trading View