Well, we went into the weekend expecting a considerable amount of volatility, and unfortunately, have come out of it pretty disappointed. The reward halving promised to polarize sentiment, and to some extent it did, but this hasn’t really translated to any real bitcoin price movements – at least, that is, nothing sustained. Price is down a little bit on the end of last week, and we may see some action today if volume picks up (main stream media out of the US will likely cover the halving and – in turn – draw some speculative attention to the space). Whatever happens, we are going to set up against price as per the rules of our standard intraday strategy. This way, we are able to draw a quick profit from a scalp position if price moves a bit, and also get in on the right side of any sustained movements if we do get any volume driven action.

So, with this said, and as we move into a fresh week of trading in the bitcoin price, here’s a look at our key levels, our targets and our risk management parameters for the European morning session.

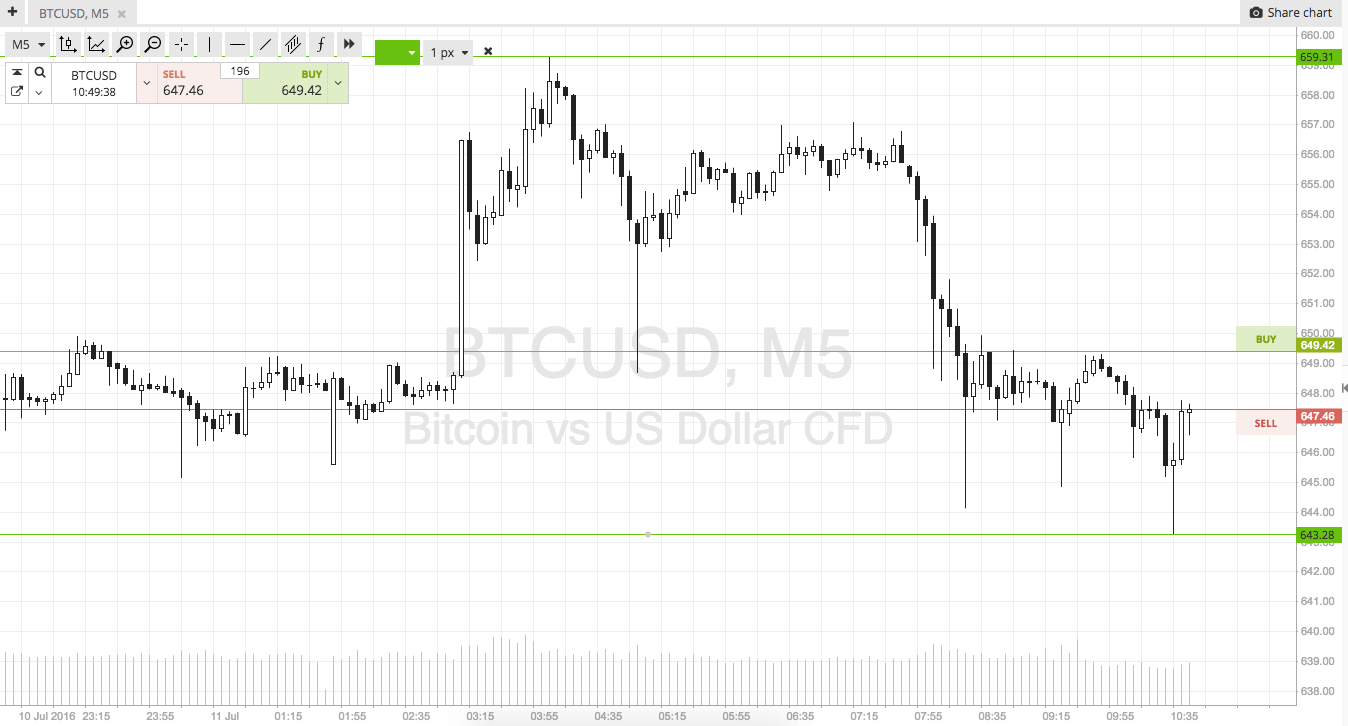

The chart below is a 5-minute timeframe candlestick chart showing the action over the weekend. Take a quick look at it before we get going to familiarize yourself with the key levels.

So, as the chart shows, the levels in focus for today’s session are in term support to the downside at 643, and in term resistance to the upside at 659. There’s just enough room for intrarange, so long at support and short at resistance. Stop at the other side of the entry.

If price breaks our key levels, we will enter in line with the break. Long on a close above resistance, targeting 670 to the upside. Short on a close below support, with an initial downside target of 630.

Charts courtesy of SimpleFX