It’s time to take a first look at the bitcoin price for today, and see if we can set up against the action seen last night I order to draw a profit from the market. It was a bit of a strange night last night. Price took a hit and gapped down on no real news, and we managed to get in short on a break of support. The trade didn’t work out, and we are now net flat on the markets, but it’s given us something to go at from an intraday perspective. We’ve got a pretty solid range, and should head in to today’s European morning session with some decent setups prepared.

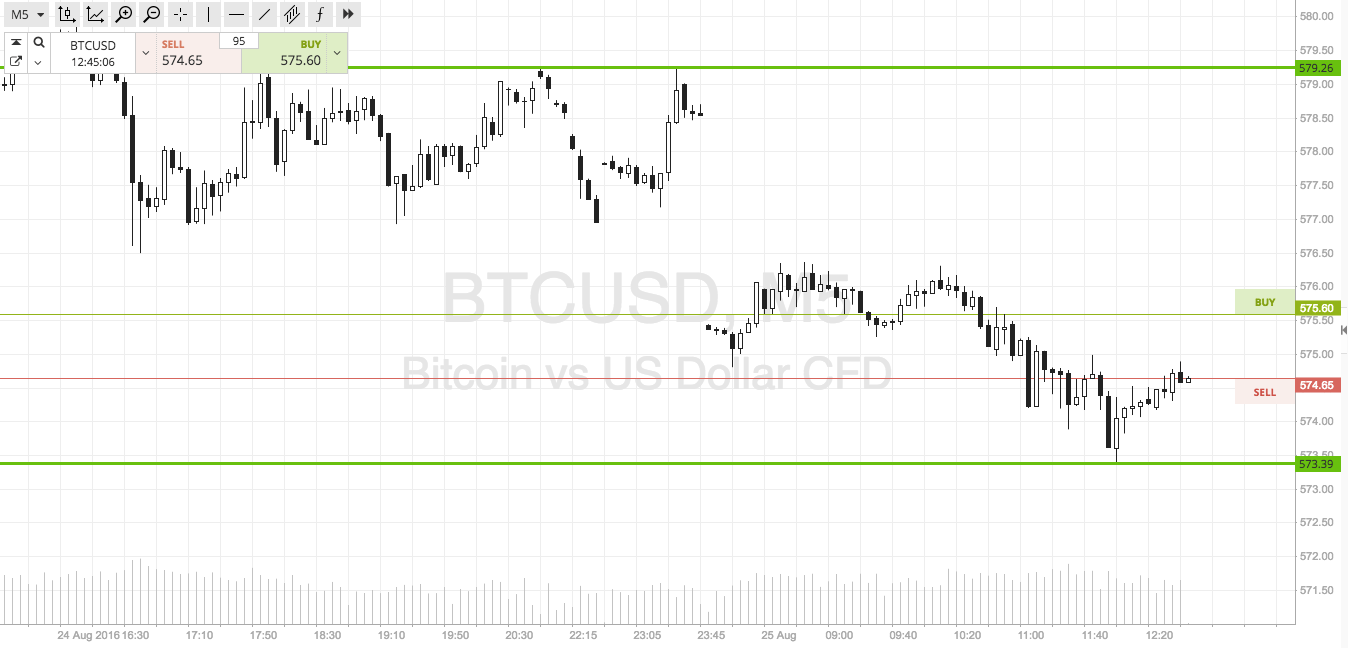

So, with that said, here’s a look at what we are going for. As always, take a quick look at the chart below to get an idea of what levels we are looking at as the defining levels of our range. It’s a five-minute candlestick chart with our range overlaid in green.

As the chart shows, the range we are going for is defined by in term support to the downside at 573, and in term resistance to the upside at 579. This a pretty tight range, so we will be just sticking with our breakout scalp strategy for now, as has been the case for the last week or so. Intrarange trades need enough room to get in and place a stop the other side of the entry level. Because of the bid ask spread, if we don’t have at lest seven or eight dollars of room (but ideally far more) between support and resistance, there’s just no way we can justify the position on from a risk perspective.

For our breakout strategy, if price closes above resistance, we will get in long towards a target of 586. If price closes below support, we’ll get in towards 565. Stops just the other side of the entry to define risk.

Charts courtesy of SimpleFX