Tuesday’s here, and as things turned out, we had a pretty interesting night’s worth of trading in the bitcoin price last night. Not because price moved considerably, or anything like that, but because we got some choppy action that fell in line with our breakout levels. Normally, choppy action is a real pain. It gets us into trades and then ends up taking them out again almost right away. That’s what stop losses are for, and it’s a pain but something we just have to accept. However, last night’s choppy action fell just about exactly where we wanted it to. We got in short, ran down to our take profit, then price turned and ran through our range to put us in long, and again, take out our profit target. We could say it’s down to excellent level placement, but that would be giving us too much credit. Sometimes the cards just fall exactly how you want them to, and this was one of those times.

Whether we’ll see a similar degree of luck in our forward operations – who knows. We’re going to go after price with a breakout strategy again, at least setting up the chance that we might see some quick profits, and see what happens.

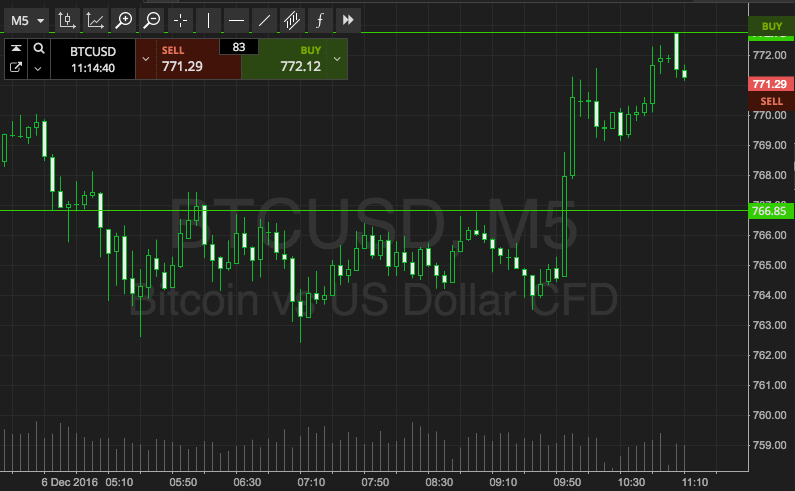

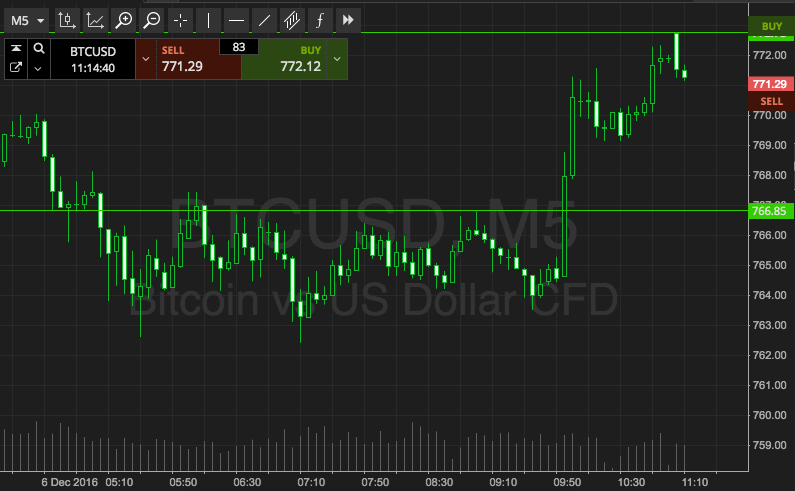

So, take a look at the chart below to get an idea what’s on, and we’ll get moving with the detail.

As the chart shows, the levels I focus for today’s session are in term support to the downside at 766, and in term resistance to the upside at 772.

We’re going to watch out for a break and a close below or above these levels respectively to get us in our positions. So, a close below support signals short towards 760 flat, and a close above resistance puts us long towards 780. Stops at 768 and 770 respectively define risk.

Happy trading!

Charts courtesy of SimpleFX