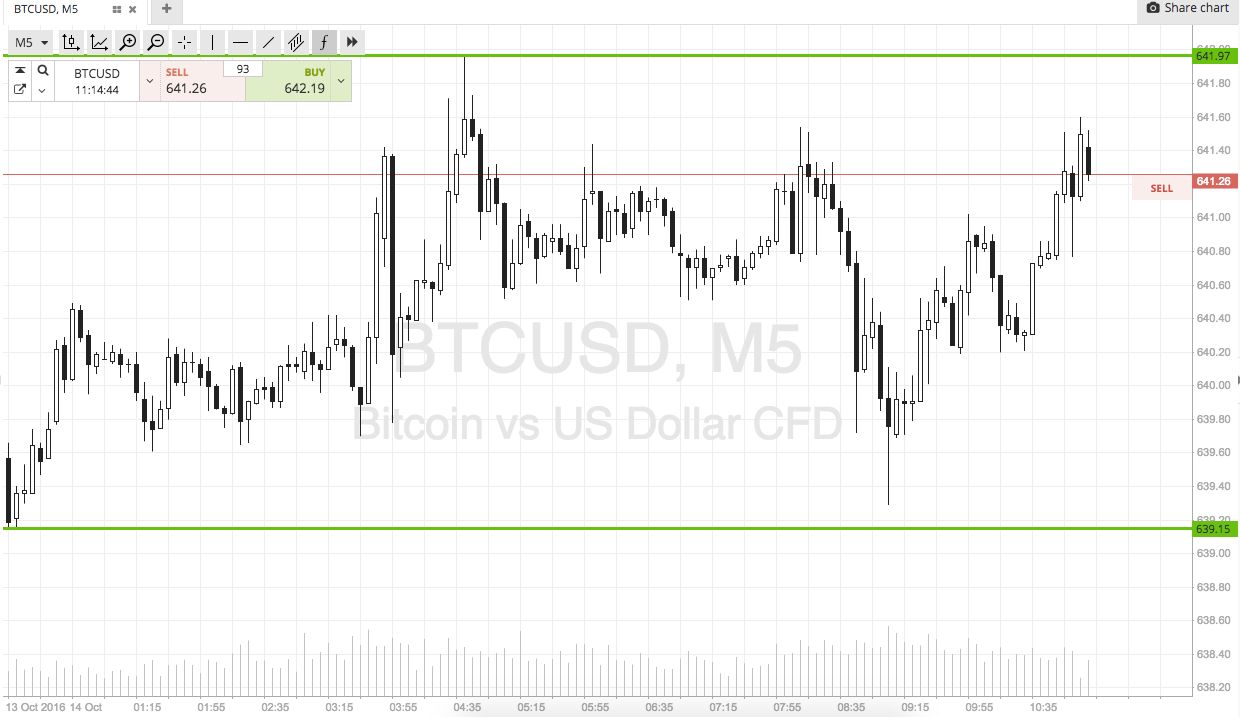

Well, here we are. Another week pretty much done in the bitcoin price, and a couple of daily looks at action to go. All in all, it’s been a great week. We’ve had plenty of opportunities to get in and out of the markets according to our intraday strategy, and we are up nicely on the market heading into the weekend. So long as we can maintain some semblance of risk management during today’s session, there is no reason we can’t head into the weekend on a high, and pull out another couple of profits from volatility in the bitcoin price throughout the European and US session moving forward. So, with that in mind, and as we head into the European morning today, here is a look at rge bitcoin price, and where we are going to attempt to get in and out the markets according to our intraday strategy. As ever, take a quick look at the chart below to get an idea of what is on.

As the chart shows, the range in focus for this morning’s session is defined by support to the downside at 639 (a little above, but that’s not important right now) and resistance to the upside at 642. Even for us, this is an incredibly tight range, so we are going to have to be pretty careful with our entries to make sure we account for the spread; or in other words, we are going to have to make sure we have a wide enough target to warrant the risk we’re taking on when we enter as the bid breaks on these positions.

So, getting into the detail, if price breaks above resistance, we’re going to enter long towards an immediate upside target of 647. A stop loss on the position somewhere in the region of 640 works well. Looking the other way, a close below support will signal a downside entry towards 634. This one is a little tighter, but a stop loss around 641 works well.

Happy Trading!

Charts courtesy of SimpleFX