In this morning’s bitcoin price analysis, we tried to urge our readers to take a step back and consider the wider picture for bitcoin right now. Sure, the bitcoin price is falling on the back of some pretty negative fundamental developments out of China but there is only so much that the Chinese government can do to beat price down and this limits the downside risk on any position held long-term. Not only that but as price continues to depreciate, the upside reward becomes more and more attractive for anybody that is willing to pick up a position in line with the downswing.

Our longer-term readers will know that we generally use intraday trading as a hedge against longer-term corrections. To put that another way, if price declines, then the value of our holdings decline but, if we are able to enter short trades in line with the fall, we can pretty much offset the net effect of a reduction in bitcoin market capitalization.

It’s not quite that simple, but that’s the overarching concept.

So, that’s what we intend to do this evening.

If price continues to decline, we jump into a short position and ride out the depreciation. If things start to recover, we will jump a long and double up on what the reversal means for us from a quantitative perspective.

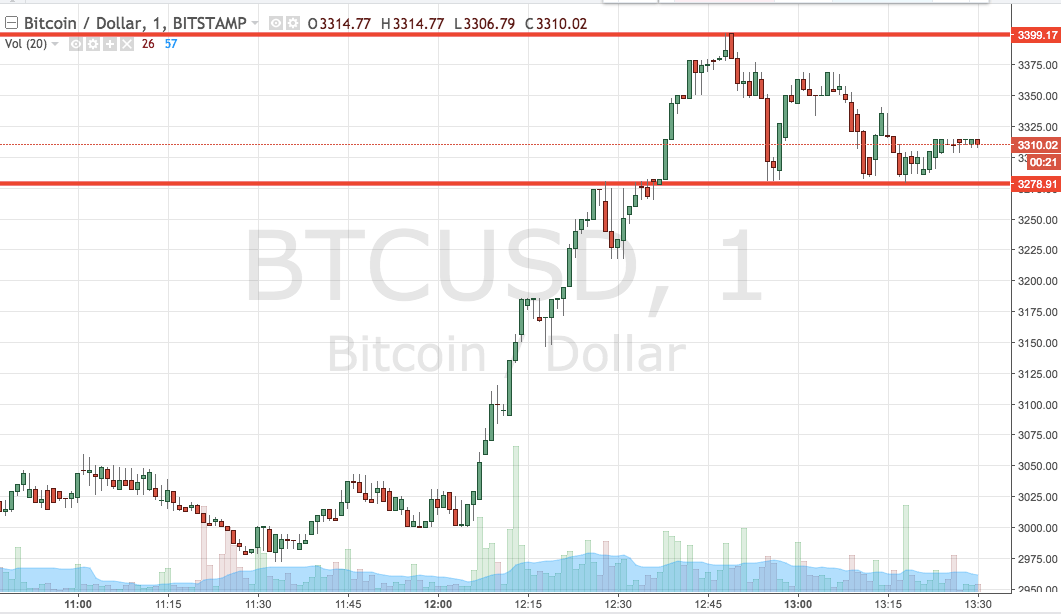

So, let’s do just that. Take a quick look at the chart below before we get started. It is a one-minute candlestick chart and it has our range overlaid in red.

As the chart shows, price has recovered substantially from this morning and our range right now is defined by support 3278 and resistance at 3399.

If we see a close below support, we will enter short towards 3200 flight. Conversely, a close above resistance will have us in long towards 3440.

Charts courtesy of Trading View