We have come to the end of the week in our bitcoin price trading efforts and it is time to take a penultimate look at the market heading into the European session start. Things have been pretty interesting this week, and we have had plenty of volatility and – with this volatility – plenty of opportunity to jump in and out of the markets according to the rules of our intraday strategy. With any luck, we will get a continuation of this sort of action heading into the weekend and be able to continue to draw profit from the market as the week draws to a close.

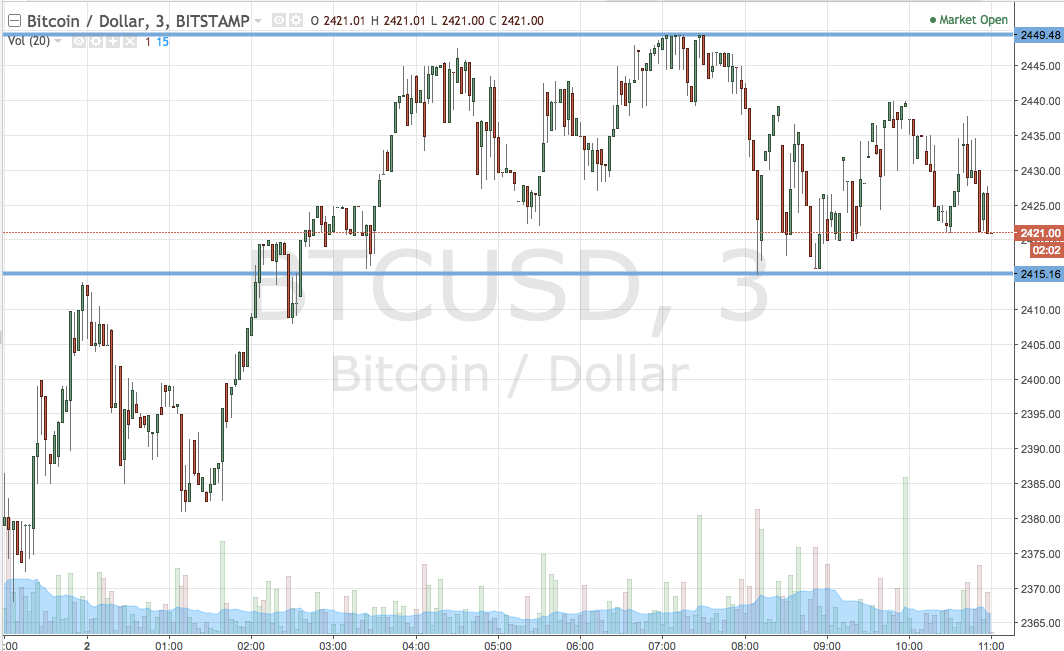

So, with this in mind, and as we head into the session today, here is a look at what we are going for in the bitcoin price and where we are looking to get in and out of the markets according to the rules of our intraday strategy. As ever, take a quick look at the chart below before we get started. It is a five-minute candlestick chart and it has our key range overlaid in green

As the chart shows, then, the range we are looking at for the session today is defined by support to the downside at 2415 and resistance to the upside at 2449. We are going to initially look at getting into a long entry if price breaks (and subsequently closes) above resistance. In this trade, an entry towards an upside target of 2470 looks good. A stop loss on the position somewhere in the region of 2443 will ensure we are taken out of the trade in the event of a bias reversal.

Looking the other way, if price closes below support, we will enter into a short trade towards a downside target of 2390. A stop loss on this one somewhere in the region of 2425 looks good for the position.

Charts courtesy of Trading View.