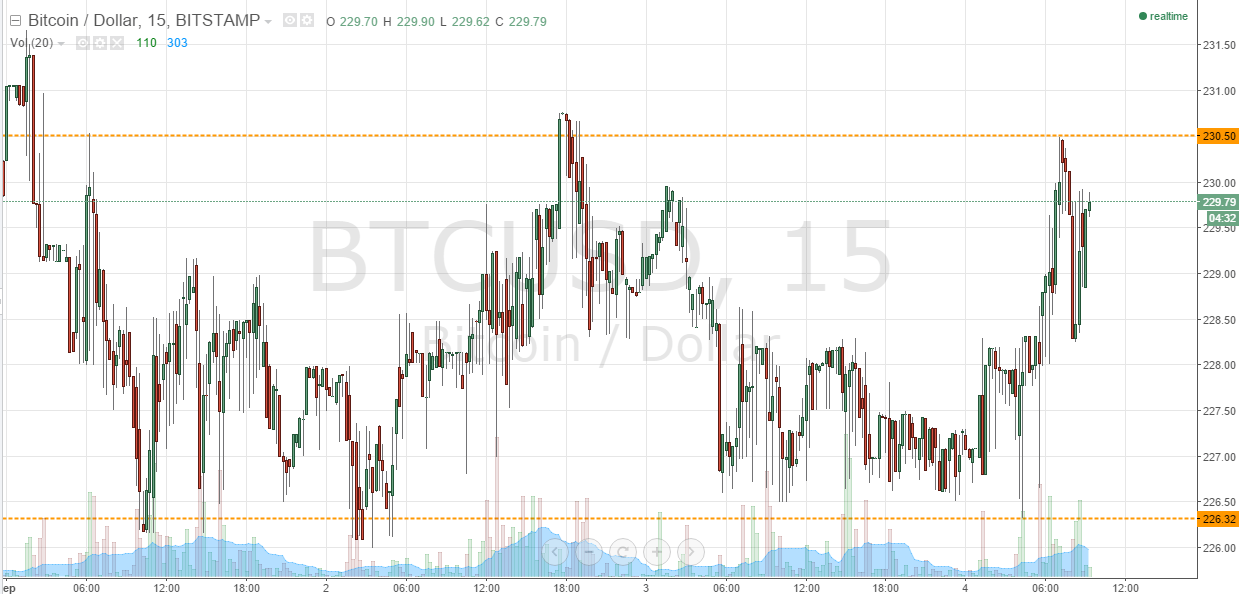

Earlier today we published our twice-daily bitcoin price watch piece. In the piece, we highlighted the levels that we would be watching throughout the European session on Friday, and suggested that – as a result of the range bound action we have seen over the past few days – we could look to enter on either a breakout or a combination of our breakout and intra-range strategies today. Action has now matured, and as we head into the weekend, what are the levels that we are watching in the bitcoin price, and where will we look to get in and out markets according to either arms of our strategy? Take a quick look at the chart.

As you see, from bouncing off in term support earlier this morning at 226.32, we traded up to reach in term resistance at 230.50 pretty quickly. However, we corrected from resistance and – despite breaking through it a short while later – failed to close above it. For this reason we did not enter any trade during today’s European session. Action has been pretty tight over the last few hours, and as such, the levels we slated as the ones to watch this morning remain the ones to watch as we head into this evening session. In term support at 226.32 and resistance at 230.50.

We will initially look for a break above 230.50 to put us long towards a medium-term target of 235 flat. On this trade, a stop loss somewhere around 229 flat will help us to maintain quite nice risk reward profile – while still leaving us enough room to avoid being chopped out of the trade. Looking the other way, a break below 226.32 would put us short towards 220 flat. Again we got quite a lot of reward tied up in this trade, so we got plenty of risks to play with. A stop loss somewhere around 227.52 things attractive from a risk management perspective.

Charts courtesy of Trading View

The usual sunday drop will happen.