Well that’s another day in the bitcoin price done, and it’s been a pretty interesting one. Price hasn’t moved to the degree we would have liked (though we’ll say it again, we expect this based on the holiday volume impact), but we did get a break on the predefined levels, and that’s put us in to a long trade, which as things stand, is still active. With this active trade in place, we’re going to abstain from entering any secondary positions. We’re still in the long that we took on the initial break of the 800 level, so to add another position to our already active roster is a bit of a stretch.

That doesn’t mean we can’t outline some levels for any readers that missed the entry this morning, however, so let’s have a go at doing just that.

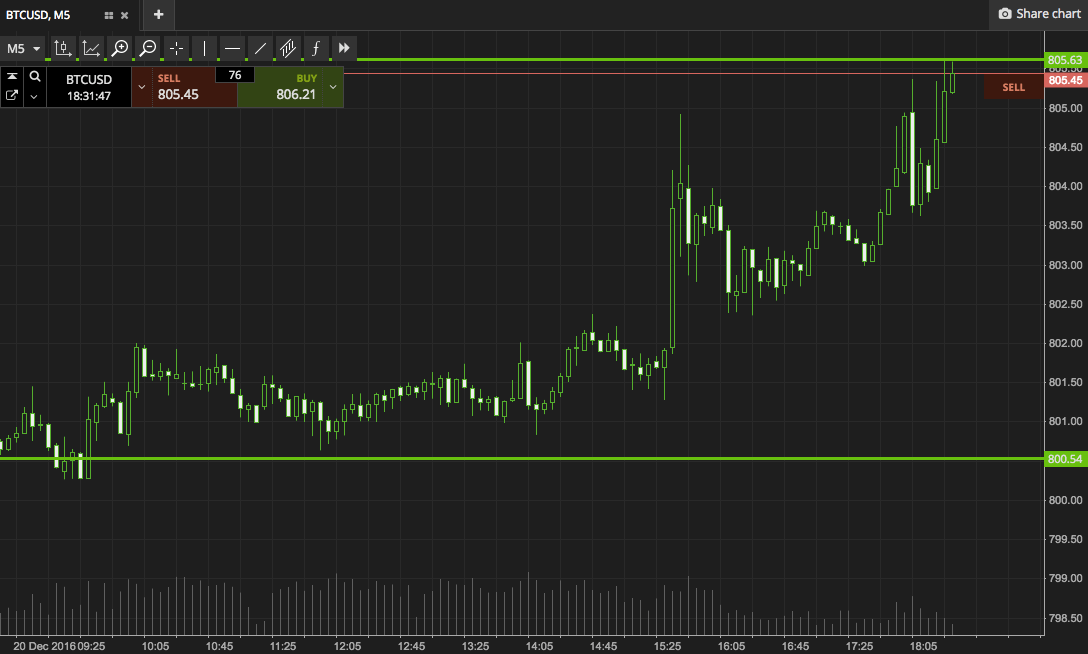

Take a look at the chart below to get an idea of what’s on, and where we are looking to get in and out of the markets on any evening time volatility. It’s a five-minute candlestick chart, and as ever, it’s got our range overlaid in green.

As the chart shows, the range we are targeting this evening is defined by in term support to the downside at the 800 flat mark, and in term resistance to the upside at 806. There’s just about enough room on this one to go at price with an intrarange approach, so we’ll be targeting support on a correction from resistance and resistance on a bounce from support.

If price breaks through resistance, we will get in a long position towards an immediate upside target of 812. A stop on the trade at 802 looks good, Conversely, if price closes below support, we’ll get in short towards 793. Again we need a stop loss, and we’re looking at somewhere around 803.

That’s all for now!

Charts courtesy of SimpleFX