In this morning’s analysis, we focused on the correction that was happening in the bitcoin price, and put forward our near term expectations for this correction. Specifically, and for those that missed the coverage, we noted that our focus was strongly biased towards the upside, based on the fact that we think price should bottom out at current levels and find some medium term support.

Action has now matured throughout the European session afternoon, and the US session is in full swing. Price has moved today, and this movement has – for the most part – been supportive of our bias.

So, with this in mind, and as we move forward into this evening’s session, here’s a look at what we are focusing on in the bitcoin price, and where we intend to get in and out of the markets according to our intraday strategy.

Again, we are going to focus on the upside primarily, and use this focus to help us navigate the risk side of our approach. However, and as we outlined this morning, we are more than happy to get in to a short entry if and when price signals a valid position.

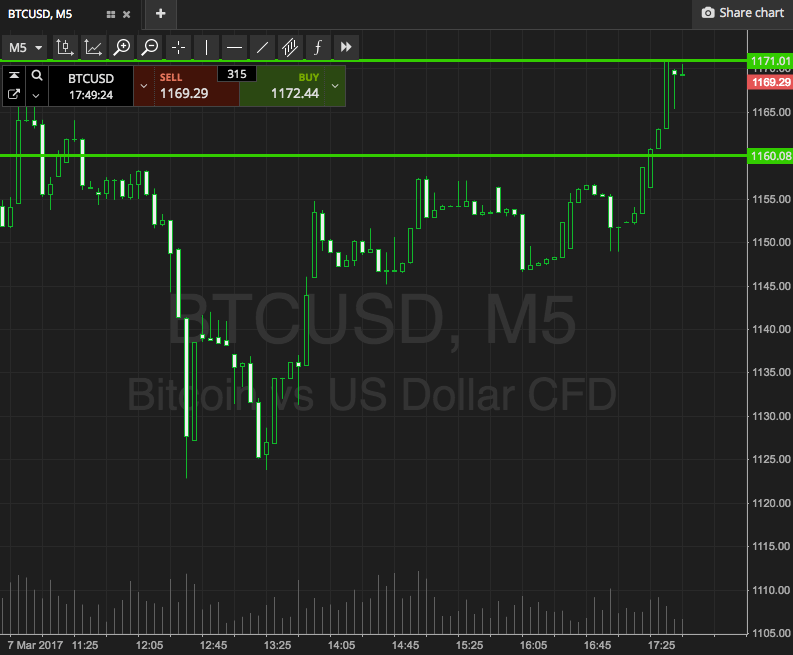

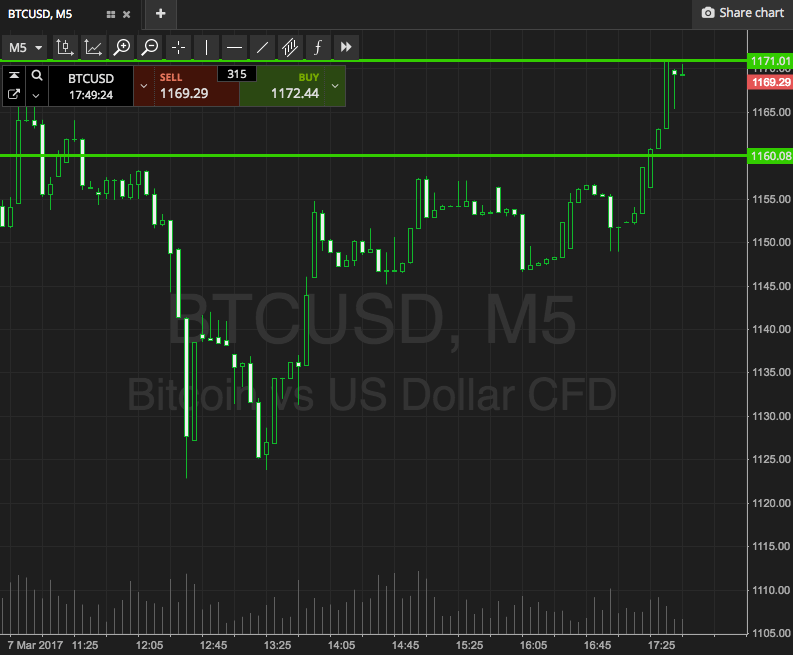

Take a look at the chart below before we get started. It’s a five-minute candlestick chart and it’s got our key range overlaid in green.

As the chart shows, the range in focus is defined by support to the downside at 1160, and resistance to the upside at 1171. If we see price break through resistance, we will look for a close above that level to validate an immediate upside entry towards 1185. A stop on the trade at 1167 works well.

Looking the other way, a close below support will signal short towards a downside target of 1150. A stop on this one at 1165 is good.

Let’s see what happens.

Charts courtesy of SimpleFX