Well, that’s the first day of the fresh week over and done with, and we’re about to head into the late evening session out of the US. Price has been pretty good to us today – we managed to get in and out according to our strategy on the smaller timeframes, for an albeit small scalp profit – and we’re hoping that things pick up this evening and we can get into some sustained action. Ideally, that is, upside action.

If we do get some action, and price heads up towards the 800 flat mark, we will think about widening out the timeframes on our focus charts and seeing if we can bring in a slightly higher return on the positions.

That’s for later on, however. Right now, we’re focusing on the close of the US afternoon session and the subsequent Asian morning.

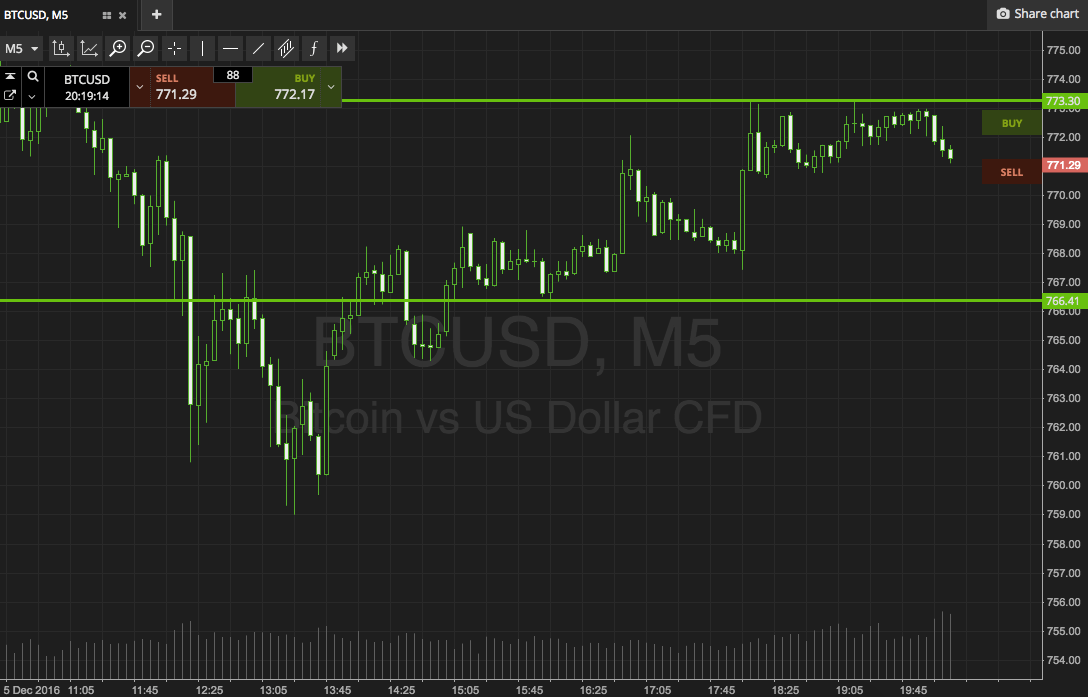

So, with this in mind, let’s take a look at the levels in focus for this afternoon, and wee where our predefined entries can get us in and out of the markets on any volatility. As ever, take a quick look at the chart below to get an idea of the levels in focus. It’s a five minute candlestick chart, and it’s got our key levels overlaid in green.

As the chart shows, we are looking at in term support to the downside at 766 flat, and in term resistance to the upside at 773.

We are going to get in long towards 780 if price breaks through resistance, and short towards 758 flat if price breaks support. A stop just the other side of the entry on both counts defines risk nicely. In the instance of both of these trades, we’ll be looking at placeing a stop loss on the short trade somewhere in the region of 769, and for the long trade, somweher around 770 flat.

Charts courtesy of SimpleFX