Here we are at the beginning of a new week, and chances are volume is going to be down today when compared to our standard Monday volume. Why? Because the US is shut down for Labor Day, and this means the usual European/US crossover (when the US market opens and the European market hits a mid afternoon swing) is not going to take place. Historically, and this applies to all financial markets, not just that of bitcoin, this crossover serves up quite a bit of volatility. We’ve had many a breakout entry mid afternoon Europe solely based on US participation initiation, and it’s always a nice little kicker to take us into the close of Europe.

What does this mean?

Well, it doesn’t mean we won’t see any action, just that it will likely be concentrated across the European morning, then we will probably see a bit of a lull throughout what would be the US morning session, and then, with any luck, things will pick up again later tonight as the Asian session comes in to play.

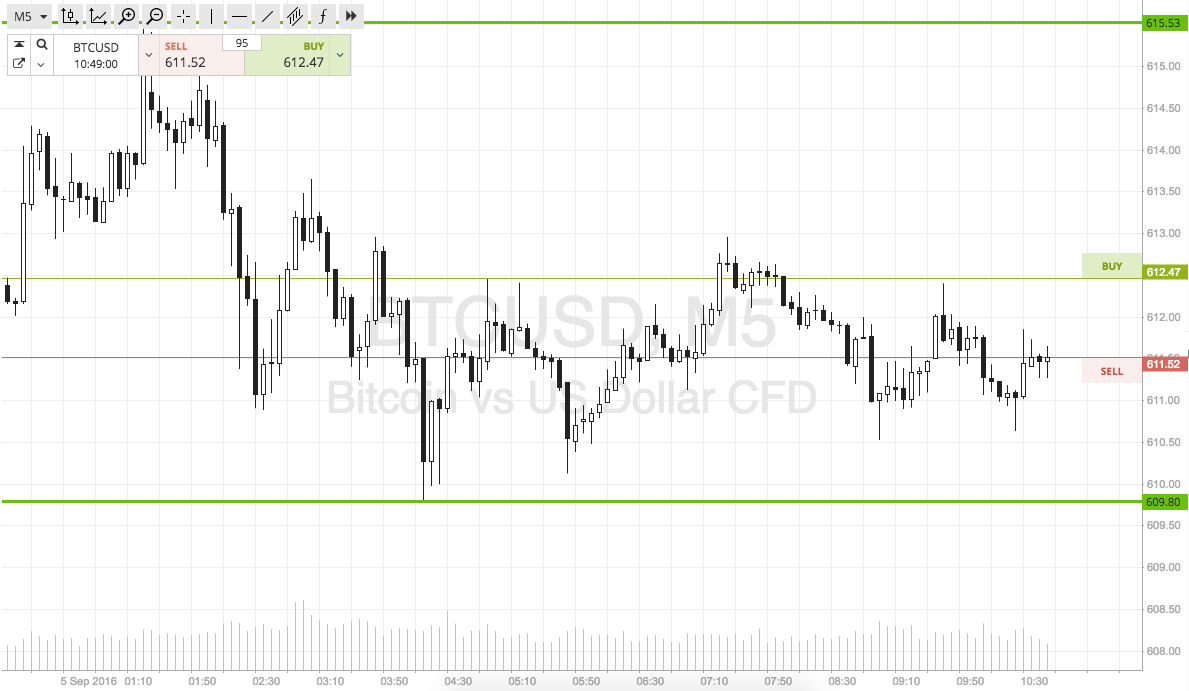

So, with this in mind, and looking forward to the European morning session ahead of us, here’s a look at what we are going for in the bitcoin price today. As ever, take a quick look at the chart below before we get going. It’s an intrarange chart showing the last twelve hours’ worth of action using five minute candlesticks, and it’s got our range overlaid in green.

As the chart shows, our range in focus for today’s session is defined by support to the downside at 609 and resistance to the upside at 615.

We are going at price with a breakout strategy only today, so if price breaks above resistance, we will look to get in long towards 620 flat. Stop at 613. Conversely, a close below support signals short towards 604.

Charts courtesy of SimpleFX