And we’re off on another day’s worth of trading in the bitcoin space. Things have been pretty good to us this week so far. There have been plenty of opportunities to get in and out of the markets according to the rules of our intraday strategy, and with these opportunities have come a few decent trades. Those who follow our analysis regularly will know that our strategy is set up to be adaptable to whatever kind of action comes our way. If we get short, sharp, choppy action, we can get in and out of the markets quickly using tight targets and stops.

If, on the other hand, as we’ve seen over the last few days, we get breakouts coupled with sustained momentum runs, then we can get in on the breakout and stay in for some slightly longer targets.

The second of these two scenarios is our preferred, of course, as it’s a simpler approach. That said, a profit is a profit, so as long as we’re net black, we’re not complaining.

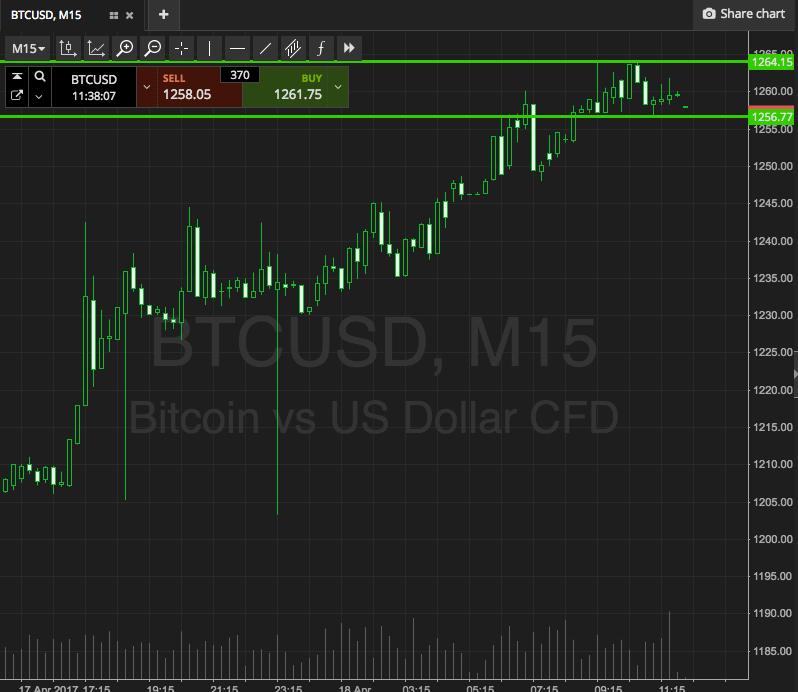

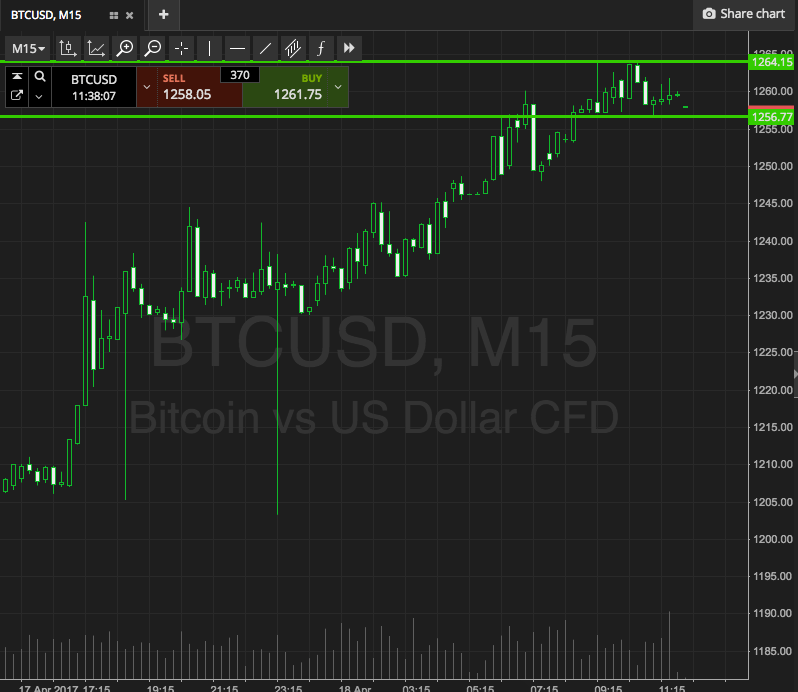

So, let’s get to today’s action. As ever, before we get to the detail, take a quick look at the chart below to get an idea of what’s on and where we’re looking to get in and out of the markets as the bitcoin price moves during today’s European session.

As the chart shows, the range we’re looking at for the session today is defined by support to the downside at 1256, and resistance to the upside at 1264. We’re sticking with breakout for the session today.

If we see price break above support, we’ll be looking at getting in long towards a target of 1275. Conversely, a close below our predefined resistance level will get us in short towards 1245.

Stops on both positions just the other side of the entry will ensure we’re taken out in the event of a price reversal.

Charts courtesy of SimpleFX