So here we are on the brink of another Thursday trading session out of Europe in the bitcoin price. Things are moving pretty fast at the moment so we won’t waste too much time looking at what happened overnight for fear of missing an entry signal on any near-term volatility. What we will say, however, is that priced dipped quite considerably yesterday but action throughout the overnight session seems to have served up some degree of reprieve.

Specifically, we got a bounce from a level that we had previously slated as key support and the bounce brought price to trade at around current levels just shy of 2400. If the bitcoin price can now hold near these levels, and ideally, if we can get a clean break above the 2400 flat level, chances are we will be in for a bullish day today.

So, with this noted, and as we move forward into the session, here is a look at what we are focusing on in the bitcoin price and where we intend to get in and out of the markets according to the rules of our intraday strategy.

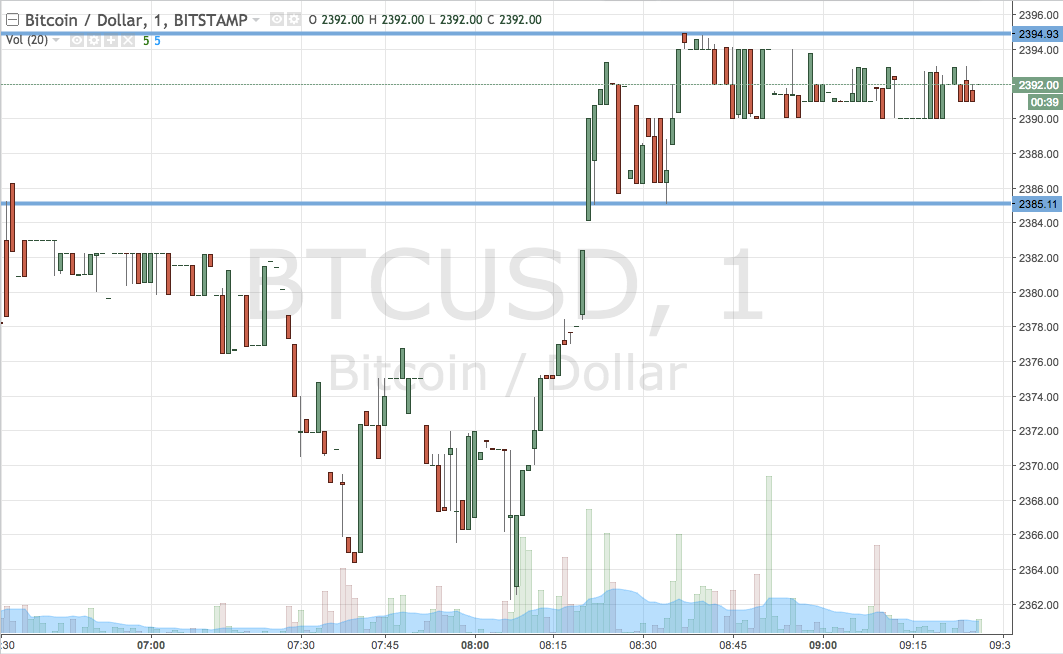

As ever, take a quick look at the chart below before we get started. It is a one-minute candlestick chart and it has our key range overlaid in blue.

As the chart shows, the range we are focusing on for the session today comes in as defined by support to the downside at 2385 and resistance to the upside at 2394. If we see price break through resistance, we will look out for a close above that level to validate an upside target of 2425. Conversely, a close below support will get us in short towards a downside target of 2360. A stop on both positions will ensure we are taken out of the trades in the even to of a bias reversal.

Let’s see how things play out.

Charts courtesy of Trading View.