So that’s another day completed, and in all honesty, it’s not been a great one for either the bitcoin price or our intraday strategy. It’s not that we’ve been chopped out, or that price has collapsed, or anything like that.

It’s just been pretty dull.

Price has remained relatively flat throughout the whole day, and we haven’t really seen any volatility, volume and – by proxy – momentum. As we move into this evening’s session, chances are things are going to die down even more. There’s no real US volume based on the markets being closed for Washington’s birthday today, and chances are things aren’t going to pick up until the Asian session kicks off early morning tomorrow.

That means we’ve got something to look forward to, of course, and that’s what we are going after with this coverage. Basically, we’re looking to outline a few key levels with which we can take advantage of the bitcoin price moving as the overnight session matures, and price comes into its own tomorrow morning.

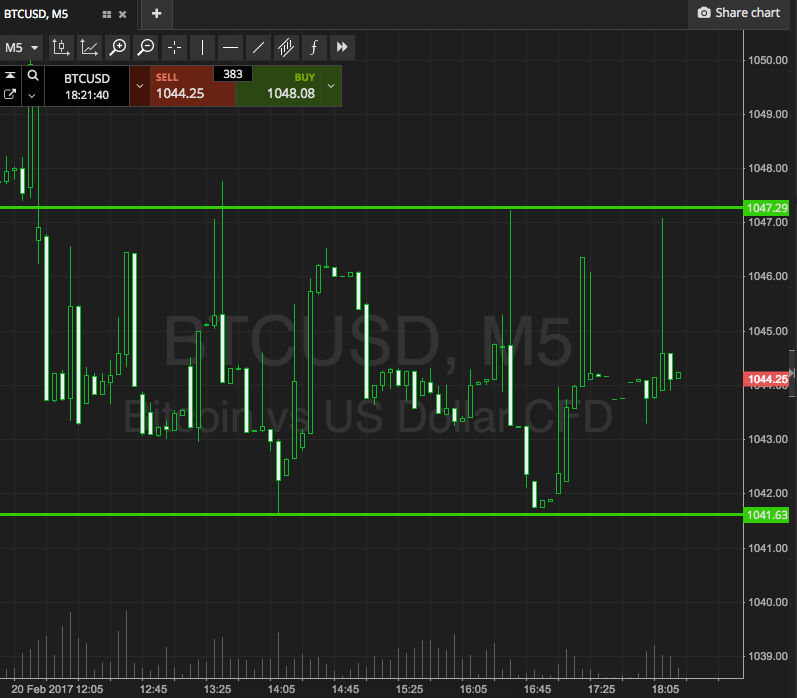

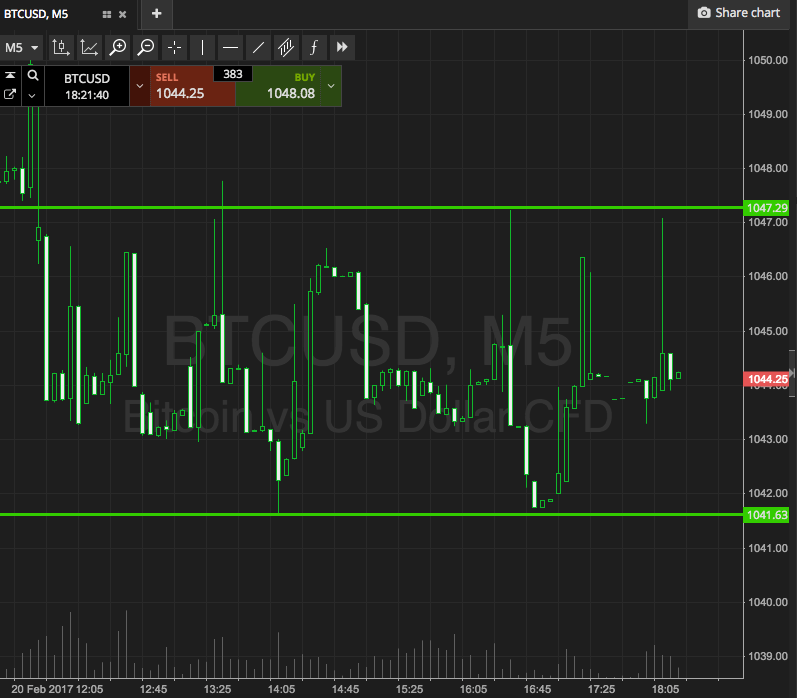

So, with this in mind, let’s get some key levels in play. As ever, take a look at the chart below to get an idea of what’s on and where things stand right now. It’s a five-minute candlestick chart with the day’s action illustrated, and our range overlaid in green.

As the chart shows, the range in focus this evening comes in at support to the downside at 1041, and resistance at 1047. It’s a little tighter than normal, but should give us something to play with as a result.

So, standard rules apply.

If we see price break above resistance, we are going to look at getting in long towards an immediate target of 1055. A close below support will signal short towards 1032.

Stops just the other side of the entries, as usual, to kill of risk on the positions.

Charts courtesy of SimpleFX