In this morning’s analysis, we suggested that $4000 would be a level in the bitcoin price from a psychological perspective. Basically, when price breaks through these sort of psychologically significant thresholds, we nearly always see a degree of follow-through and, in turn, a sustained run.

The hope is that, on the back of this sustained run, we then see a hold above the just broken level and, in the event of a retest, a bounce.

We are now heading into the close of the European session and this is exactly what happened today. Price broke through $4000 earlier on and then ran up towards mid-afternoon highs in and around $4070. We then saw a correction back towards the broken level and we saw $4000 hold as support with a subsequent bounce kicking off a sustained run up towards current levels in and around $4100.

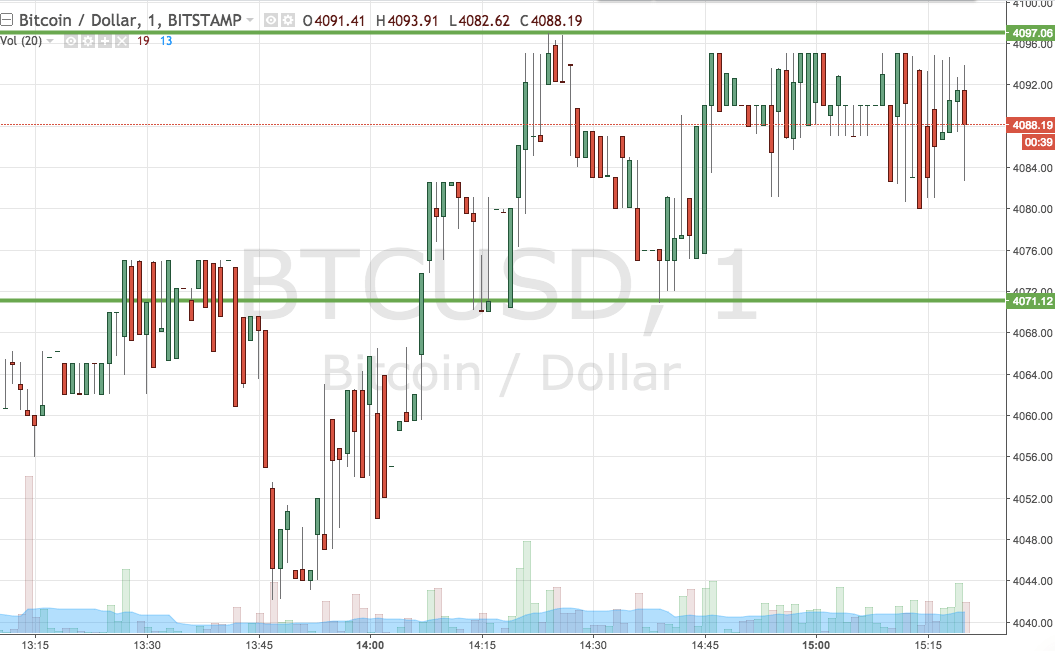

So, let’s get some levels outlined that we can use for the session this evening and see if we can’t continue to draw a profit from the market as and when the volatility continues. As ever, take a quick look at the chart below before we get started so as to get an idea where things stand and what happened today. It is a one-minute candlestick chart and it has our range overlaid in green.

As the chart shows, the range we are using for the session tonight is defined by support to the downside at 4071 and resistance to the upside at 4090. Standard breakout rules apply, so we will enter long on a close above resistance towards an upside target of 4130 and we will enter short on a close below support towards a downside target of 4025. Stop losses on both positions will take us out of the trades in the event that things turn against whose us.

Charts courtesy of Trading View