So that is the day done in our bitcoin price trading efforts and it has been a bit of an odd one. We established early on in the day that we would try and avoid bringing our intrarange strategy to the table and that a breakout approach would be more suitable given the type of action we were seeing overnight last night.

As it turns out, and as we head into the US afternoon going forward, an intrarange strategy might’ve been more appropriate.

For those new to our approach, an intrarange strategy allows us to draw profit from action within a range; so entering long on a bounce from support and short correction from resistance – generally targeting the opposing levels. A breakout approach, on the other hand, dictates that we enter when price breaks through one of our key levels.

Today’s trading was range bound, meaning we might have had better luck with the former.

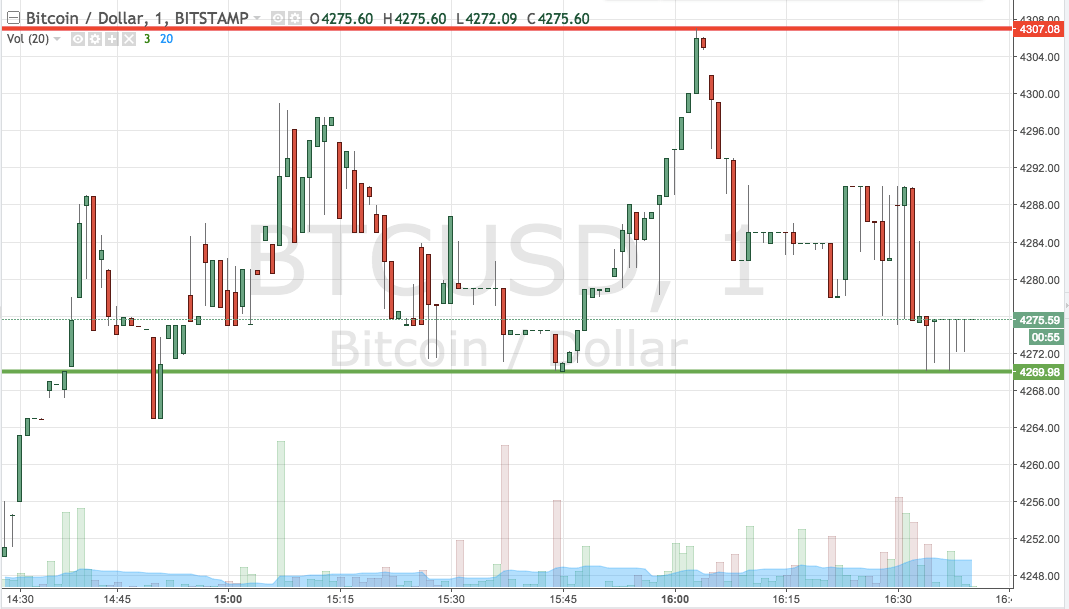

Anyway, there isn’t much we can do about it now. Let’s get some levels in place that we can use for the session this evening and try to pull back the day from a profit perspective. As ever, take a quick look at the chart below before we get started so as to get an idea where things stand and where we are looking to jump in and out of the markets if and when things move. It is a one-minute candlestick chart and it has our range overlaid in red and green.

As the chart shows, the range we are using for the session this evening is defined by support to the downside at 4269 and resistance to the upside at 4307. If we get a close below support, we will enter short towards a downside target of 4210. Conversely, a close above resistance will signal a long entry towards a target of 4345.

Let’s see how things play out.

Charts courtesy of Trading View