Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

That’s the first day of the week done and dusted out of Europe in the bitcoin price and it’s time to take a look at how action played out today and to use our interpretation of this action to form a bias as to how we might be able to draw a profit from the market this evening. Things have been pretty exciting once again and we’ve had plenty of opportunities to jump in and out of the markets according to the rules of our strategy. With any luck, we’ll get a continuation of this action as the European markets draw t a close and the US session takes over. We often get a spike in volume when the sessions cross over and with this spike in volume can come a bit of added volatility in the markets.

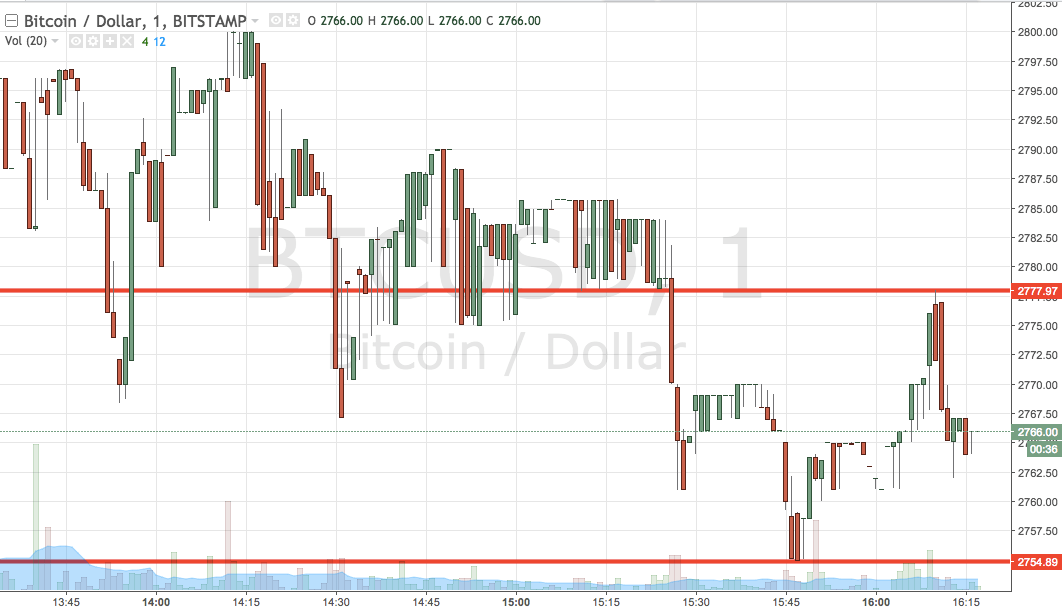

Let’s not hang around then – let’s get our key levels in place and put forward a strategy with which we can keep things moving into this evening’s session. As ever, take a quick look at the chart below before we get started so as to get an idea of what’s on and where things stand right now. It’s a one-minute candlestick chart and it’s got our key range overlaid in red.

As the chart shows, the range we are going to use tonight comes in as defined by support to the downside at 2754 and resistance to the upside at 2777. We will initially look out for a close above resistance to give us an excuse to get in long towards an immediate upside target of 2800. A stop on the trade at 2770 will take us out of the position if things turn against us.

Looking short, a close below support will get us in towards 2725 and we’ll place a stop at 2762 to make sure we don’t lose too much if things turn against us.

Let’s see what happens.

Charts courtesy of Trading View