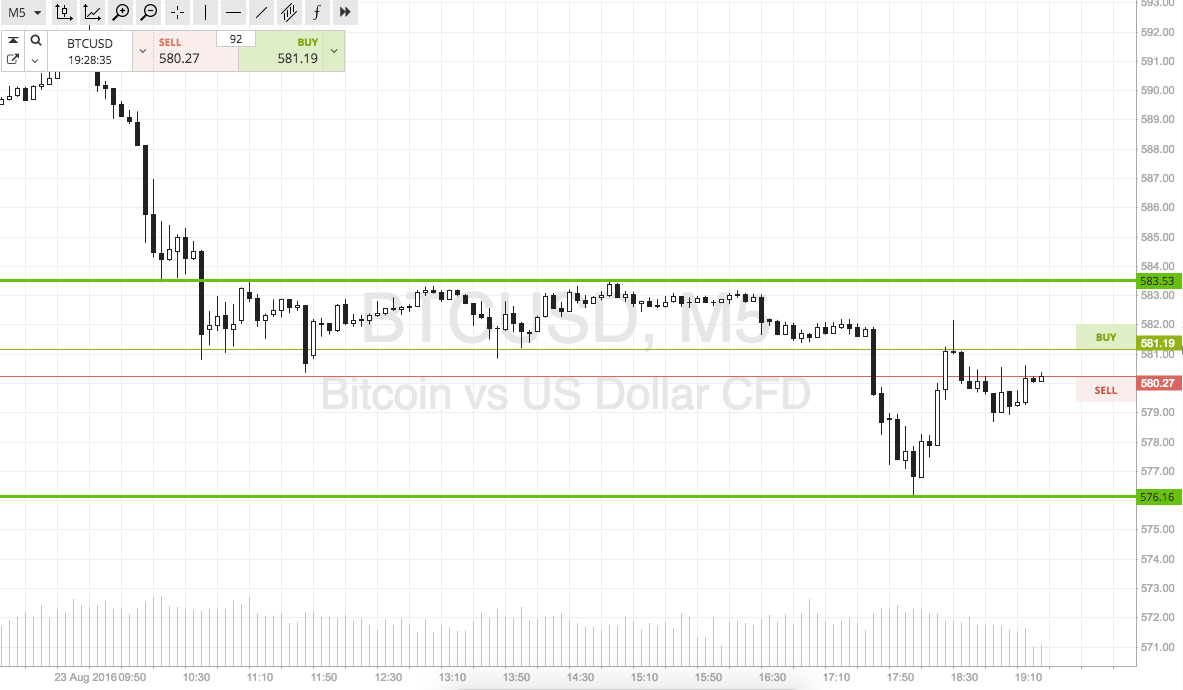

The trading day has now come to an end out of Europe in the bitcoin price, and it’s time to publish the second of our twice daily bitcoin price watch analyses. Action has been pretty uninspiring throughout the day’s session, with very little movement to go at from a breakout perspective. It’s at times like this that trading the bitcoin price can get pretty dull, but it’s also at times like this that the most money is lost based on erratic trading decisions. Best to stick to our strategy (even though it’s not giving us any entries) and wait until we get an organic signal rather than force one. With this in mind, let’s take a look at what we are focusing on this evening. As ever, get a quick look at the chart below to get an idea of our primary range for the session going forward. It’s an intraday chart with five minute candlesticks, showing the last twelve hours’ worth of action and our range is overlaid (and slightly adjusted from this morning) in green.

As the chart shows, the range in focus for this evening is defined by in term support to the downside at 576 and in term resistance to the upside at 583 flat. There’s probably just enough room to bring an intrarange strategy into play tonight, so long at support, short at resistance, stop just the other side of the entry on the respective bounce/correction. For our breakout entries, we will be looking to get in long towards an immediate upside target of 595 if price closes above in term resistance. A stop loss on the trade at 581 keeps risk tight. If price closes below resistance, we will get in short towards 570 flat. A stop on this one somewhere in the region of 578 keeps our risk tight on the trade.

Happy trading!

Charts courtesy of SimpleFX.