It has been quite a while since we incorporated our intrarange strategy into our intraday efforts in the bitcoin price. The reason for this is that price action has been dominated by sustained momentum, with breakouts being the order of the day and any entries running through to targets (or stop losses) relatively quickly. Our intrarange strategy is far more suited to sideways, consolidating action as opposed to trend type movement.

Our intrarange strategy is far more suited to sideways, consolidating action as opposed to the trend type movement.

At the end of last week, price returned to its overarching bullish momentum, having spent the first few days of the week correcting the previous upside run. During today’s session, we expected that we would see a continuation of this bullish momentum, but instead, we have seen sideways, choppy action – action that is far more conducive to our intrarange strategy than our breakout strategy.

With this in mind, and as we head into this evening’s session out of Europe, we are going to move forward with our intrarange approach and see how it fares.

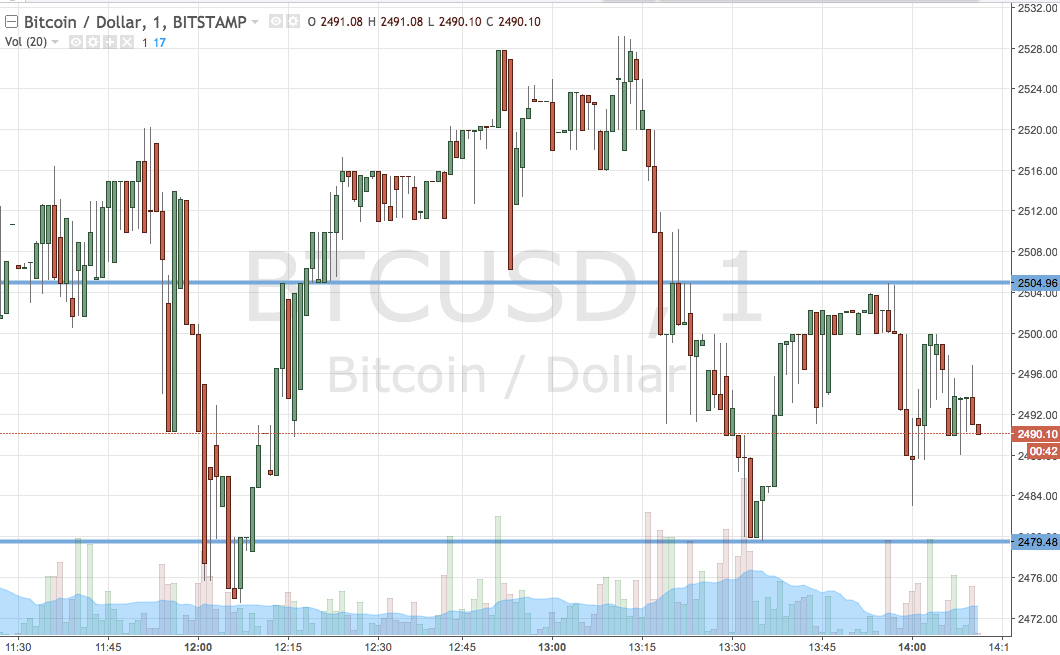

Before we outline our key levels, then, take a quick look at the chart below. It is a one-minute candlestick chart and our key range is outlined in blue.

As the chart shows, our range for this evening (and the range of which we will be going at price with our intrarange approach) is defined by resistance to the upside at 2504 and support to the downside at 2479. It is a pretty tight range for an intrarange approach, but so long as we keep our risk tight, it shouldn’t be a problem.

So, if we see price bounce from support, we will enter long towards an upside target of resistance. A stop loss just below support, somewhere in the region of 2474 defines risk nicely. Looking the other way, a correction from resistance will signal a short trade toward support. Again we need a stop loss on this one and somewhere in the region of 2510 is good.

Let’s see what happens.

Chart courtesy of Trading View

SaveSave

SaveSave