Action in the bitcoin price over the last few days has been pretty volatile so, for the session today, we are going to widen out our range a little bit and bring our intrarange strategy into play. For those not familiar with this side of our approach, it is a way to take advantage of action within a range as opposed to just relying on breakout entries and, while it’s not always overly useful, in certain market conditions it can be extremely handy.

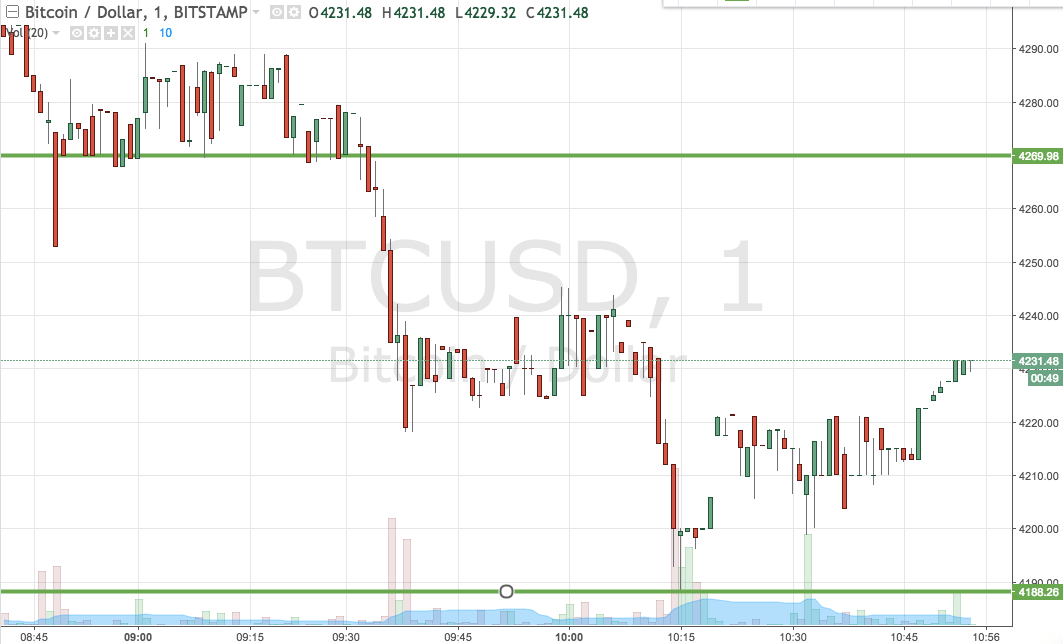

So, with that noted, let’s get some levels in place that we can use moving forward in an attempt to draw profit from the market as and when volatility presents itself. As ever, take a quick look at the chart below before we get started so as to get an idea where things stand and where we are looking to jump in and out of the markets when we see movement. It is a one-minute candlestick chart that has our key range overlaid in green.

As the chart shows, the range we are using is defined by support to the downside at 4188 and resistance to the upside at 4269. That’s about $85 or so worth of room to maneuver, so our entries are as follows:

Entry 1 – We will jump into a long position if we get a bounce from support. The upside target will be resistance (so, 4269) and we will use a stop loss somewhere in the region of 4172 to ensure that we are taken out of the trade in the event that things turn around and breakout to the downside.

Entry 2 – Looking the other way, our short trade on this range derives from a correction from resistance. If we see this correction, we will enter short towards 4188 (support) as a downside target and we will use a stop loss just above resistance, so somewhere in the region of 4280, to define risk.

Charts courtesy of Trading View