We are about to get things moving for a fresh day of trading in the bitcoin price and it’s time to put some levels together that we can use to try and draw profit from the market as and when things move. Normally, at this stage of the day, we take a look at action overnight and see how we can use any of the key levels that influenced volatility to set up against the market in the morning. However, things are moving pretty fast right now, so it’s probably best if we just jump straight into the markets, put some levels in place and see what happens.

So, with this noted, let’s get going.

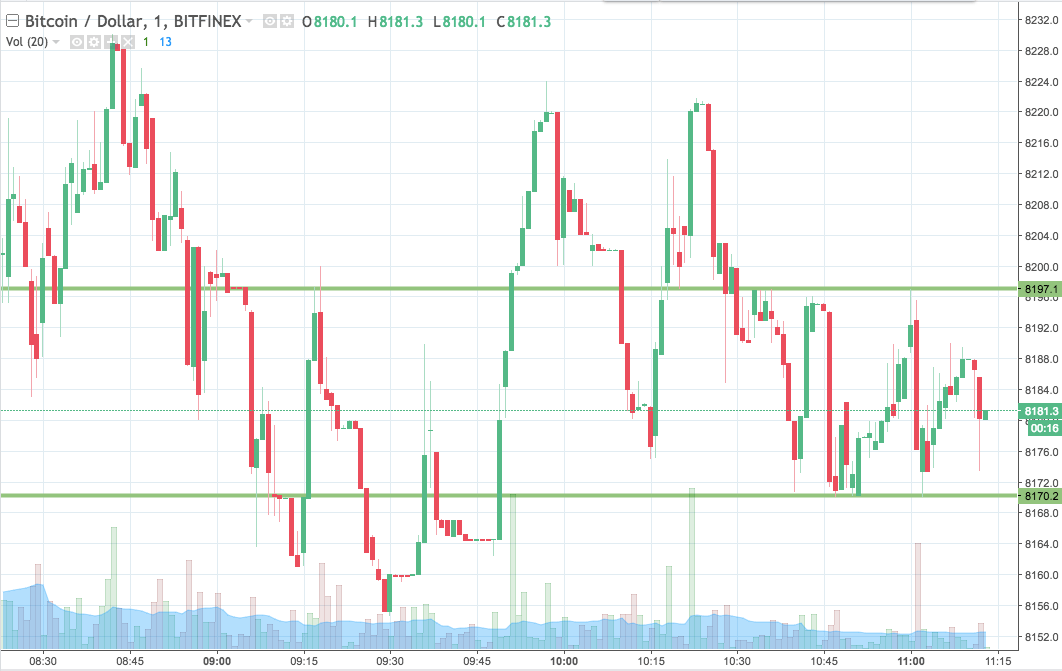

As ever, take a quick look at the chart below before we get started so as to get an idea where things stand and where we are looking to get in and out if things move in line with our strategy. It is a one-minute candlestick chocolate has our key range overlaid in green.

As the chart shows, the range we are looking up for the session today comes in as defined by support to the downside at 8170 and resistance to the upside at 8197. We are going to initially look at entering into a long trade if we see a break above resistance followed by a close above that level. On the trade, we will target an immediate upside target of 8235. Looking the other way, if we see a close below support, we will enter short towards a downside target of 8140.

We need to have stop losses in place on both positions so that we are taken out of the trades for just a small loss if things end up turning against us. With this in mind, a stop loss on each just the other side of the entry (say, $10 or so) will keep our risk parameters tight.

Charts courtesy of Trading View