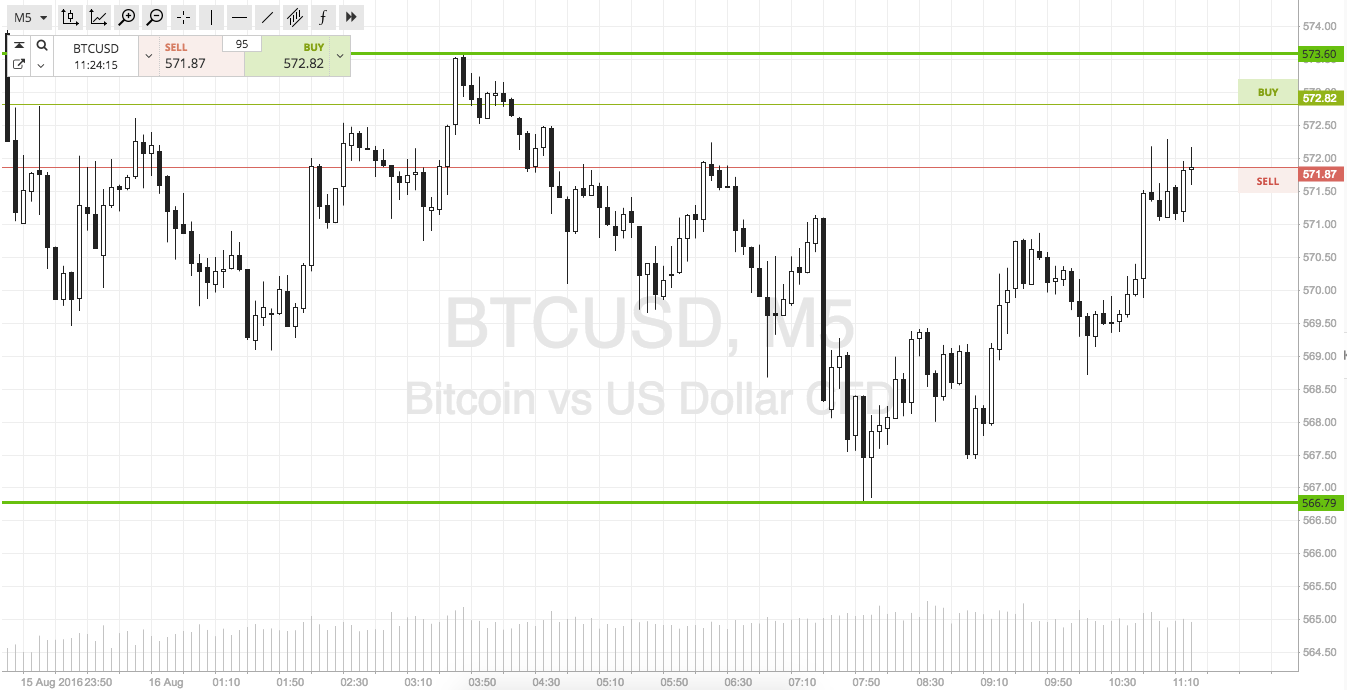

It’s Tuesday morning, and time to take a look at the bitcoin price for the first time today. Action during yesterday’s session was pretty kind to us, and we managed to get into a short term trade on a downside break for a small profit. So as we head into today’s session, we’re going to look to get into a similar trade, with our strategy defined by a relatively tight range and some scalp entries on breakouts. We will probably also look at some intrarange action, given the width of the range afforded to us from overnight trading. With this in mind, let’s get to the detail. As ever, take a quick look at the chart below to get an idea of what we’re focusing on. It is a five-minute intraday candlestick chart showing the last twelve or so hours worth of action in the bitcoin price, and it has our range for today overlaid in green.

As the chart shows, the range we are looking at for today is defined by support to the downside at 566 and resistant to the upside at 573. From an intrarange trading perspective, a correction from resistance will signal short towards support, with a stop loss just above resistance to define risk. Conversely, if price bounces from support, we will get in long towards an upside target of 575. Again, a stop loss on this one just the other side of the entry (say, somewhere around 565) works to keep things tight.

Looking at breakout, if price breaks above resistance, we will get in long towards an immediate upside target of 580. A stop loss looks good at 572. On the short side, if price breaks below support at 556, we will get in short towards a downside target of 558. We have a little bit more room on this one, so a stop loss somewhere around 568 works well.

Charts courtesy of SimpleFX