It’s time to take a look at the bitcoin price markets this Wednesday morning, and see if we can’t pick a profit from the action throughout the day. Yesterday was totally flat from a volatility perspective – price ranged pretty much all day between some tight parameters, and we didn’t get the opportunity to get into the markets for an intrarange of a breakout position. We tightened things up a little last night, bringing our range to a few dollars and going at price with a scalp strategy. We managed to get in and out of the markets a couple of times in this way – chopped out once, and a positive outcome twice – enabling us to finish net up on the Asian session.

As we head into the European session this morning, we are going to maintain much the same approach. That is, go at price with a real tight range and try to get in for a quick turnaround position; one with a slim target but an even slimmer risk profile.

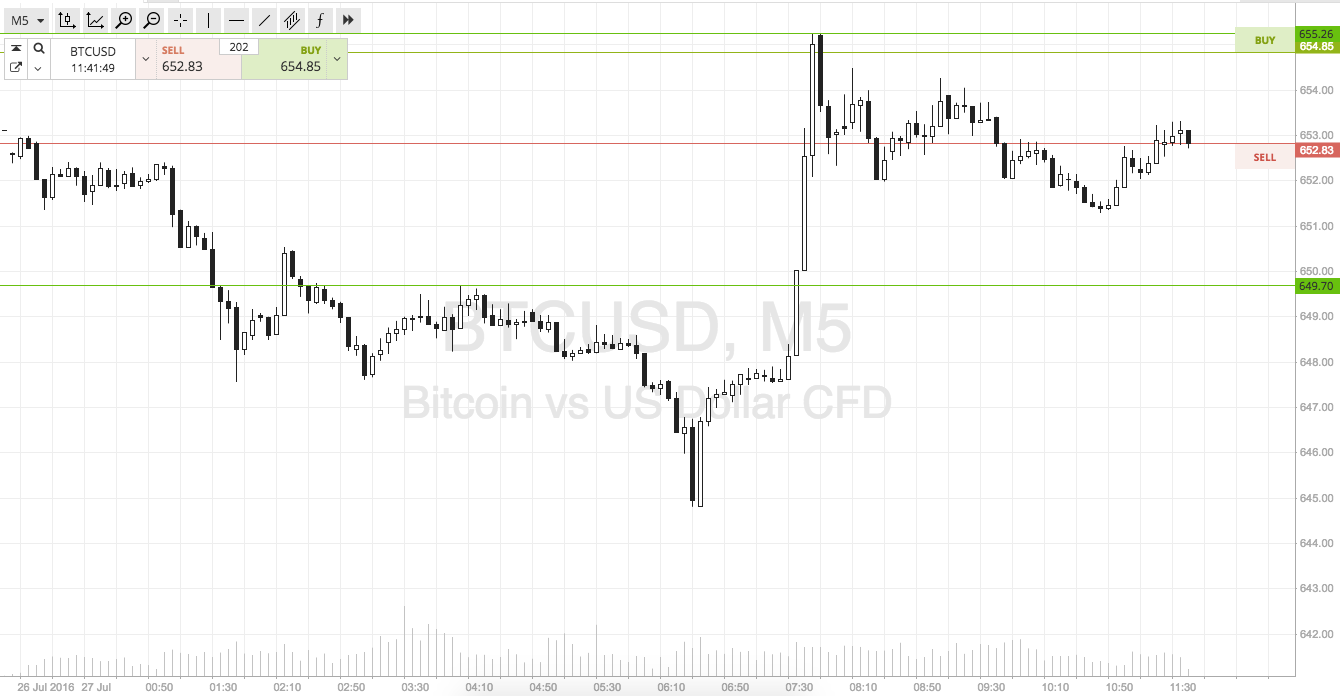

So, with that said, here’s a look at what we are going for this morning. As ever, take a quick look at the chart to get an idea of our key levels before we get going with the detail.

As the chart shows, the levels in focus right now are in term support to the downside at 649 flat, and in term resistance to the upside at 655. We are currently mid range between these two levels, with a slight downside bias, so let’s look at the short side of the equation first.

If price breaks and closes below in term support, we will enter a downside trade towards 645. A stop at 651 defines risk on the position.

Conversely, if price climbs above resistance we will get in long towards 660. Stop at 653.

Charts courtesy of SimpleFX