So that is Tuesday out of the way from a European perspective, and the bitcoin price continues to be good to us. We’re going to stick with our long term bullish bias, meaning we’ll be a little more aggressive in our long term trades than we will be in our short term positions, and see where things go.

Normally we take a quick look at what happened during the day in this section of our analysis, but price is moving pretty quickly right now, so as to avoid price moving through our key levels before we get this out to our readers (and in doing so, invalidating our entries), we’re just going to get straight into the details.

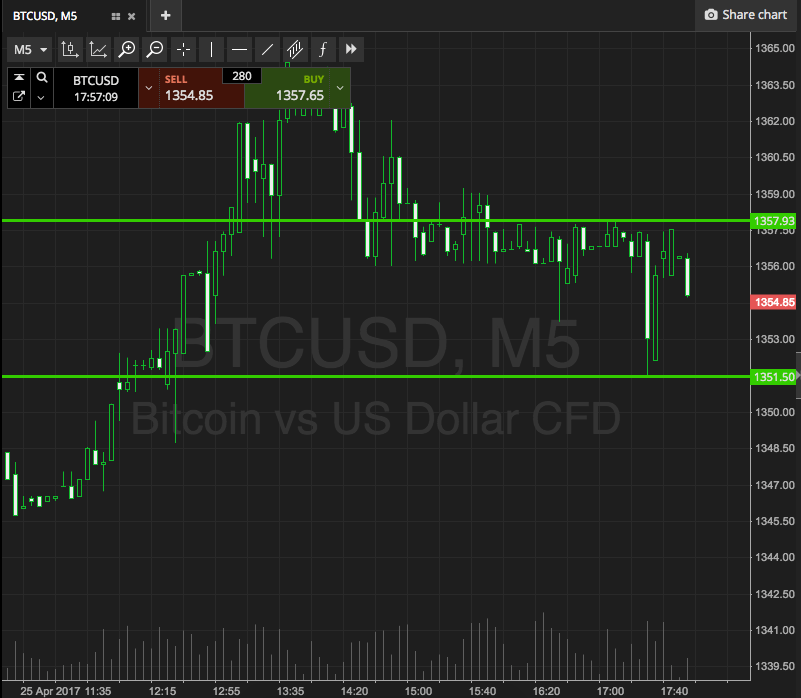

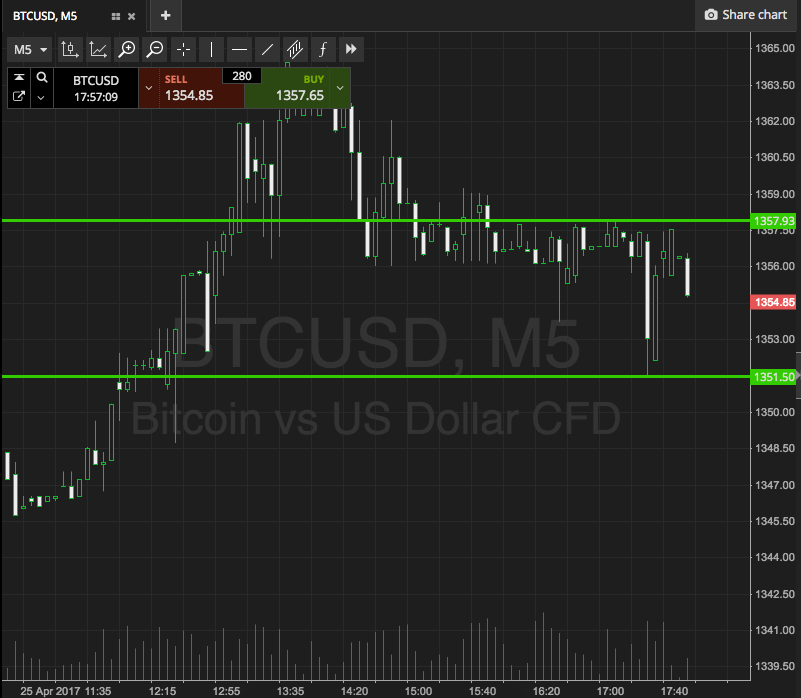

Take a look at the chart below before we get started to get an idea of what’s on. It’s a five-minute candlestick chart, and it’s got our key range overlaid in green.

As the chart shows, the range that we’re going to be using for the session this evening is defined by support to the downside at 1351, and resistance to the upside at 1357. There’s not really enough room to go at things with our intrarange strategy on this range (normally we require a range width of at least $10 to allow for risk reward ratios to play out) and so we’re looking at things from a breakout perspective only for now.

Specifically, a close above resistance will get us in to a bullish trade, with an immediate upside target of 1370. A stop loss on the trade at 1354 will ensure that we are taken out of the trade in the event of a bias reversal.

Looking the other way, a break below support will put us on alert for a close below that level, and we’ll get in short on the close towards 1340.

Charts courtesy of SimpleFX