Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

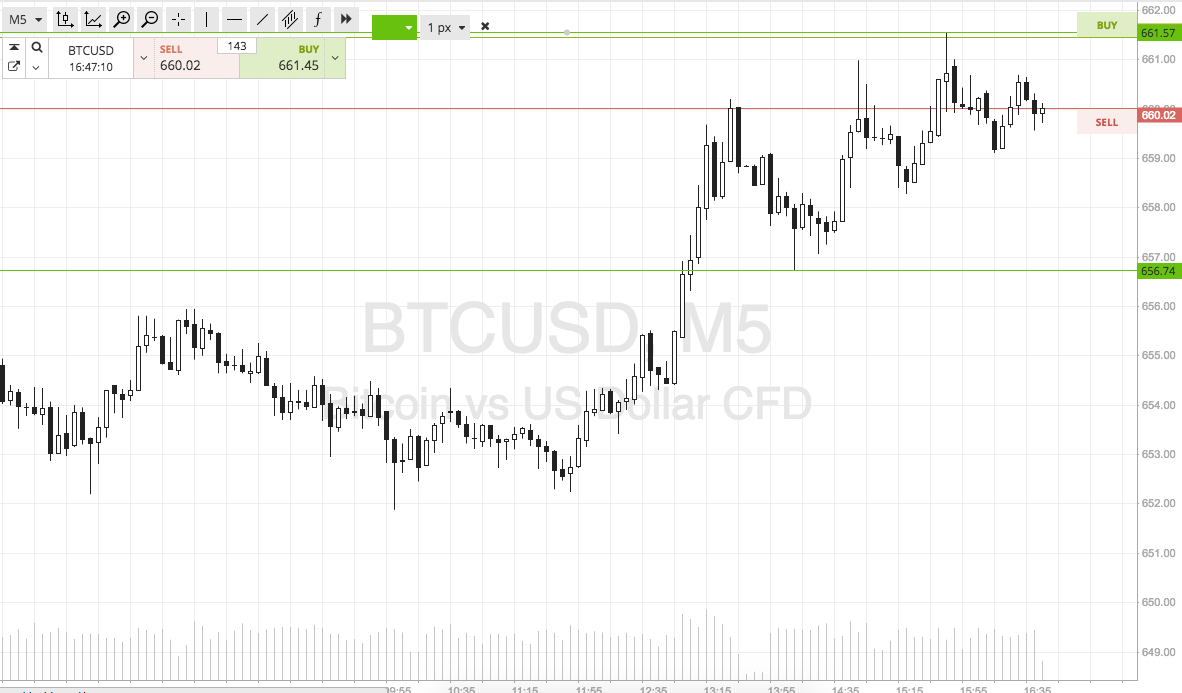

The markets are about to draw to a close in Europe, and it’s time to take our second look of the day at the bitcoin price. Things have been pretty up and down over the last twenty four hours or so, and we’ve been going at the markets with a pure scalp breakout focus. Intrarange hasn’t really been an option based on the narrow predefined ranges we’ve been working with. Action today hasn’t disappointed, and we’ve managed to get in to a long entry based on a break and a close above our predefined resistance a little earlier on this afternoon. Immediately post entry, price broke back within range and it looked for a minute like we might get taken out of the trade for a loss on a stop hit. Luckily, however, price reversed once again to the upside before reaching our stop, and has since held its upside momentum. We’ve got a target placed at 665, and price is currently hovering around the 660 flat mark. As such, we are still very much in the trade, and won’t be looking to place any fresh entries before this one draws to a conclusion.

For those that didn’t manage to get into this position, however, here’s a look at how we are going to interpret today’s price action to form a scalp breakout strategy going forward into this evening’s session.

The chart below highlights the key levels, and shows the action that got us into the trade earlier.

As the chart shows, we are shifting our range to the upside, and looking at support at 656 and resistance at 661 (the most recent swing high). If piece manages to break above resistance, it will signal a long entry towards an upside target of 670. A stop on the trade somewhere around 650 looks good.

Looking short, a close below support will signal short towards 648.

Charts courtesy of SimpleFX