In this morning’s analysis, or primary focus was a pretty wide range but some tight scalp targets and a real effort to maintain stringent risk management principles. We discussed the volatility that we’ve seen across the last few days in the bitcoin price, and noted that we might see some chop outs if we didn’t stay on top of this from a stop loss perspective. Well, it’s now time to take a second look at the market, in an attempt to gauge how we can incorporate the day’s action into tonight’s efforts. Action today has sort of continued the trend to the downside that we saw heading into this morning’s session (price was hovering just above support when we performed the first of our twice daily analyses) and we are currently in a short position. We entered on a break of support and we’ve got an immediate downside target of 660 flat.

With this in mind, we’re going to refrain from setting any more entries this evening. That is, at least, for as long as we maintain this position. If price takes out our target and we are net flat, we will look to enter according to some refined levels.

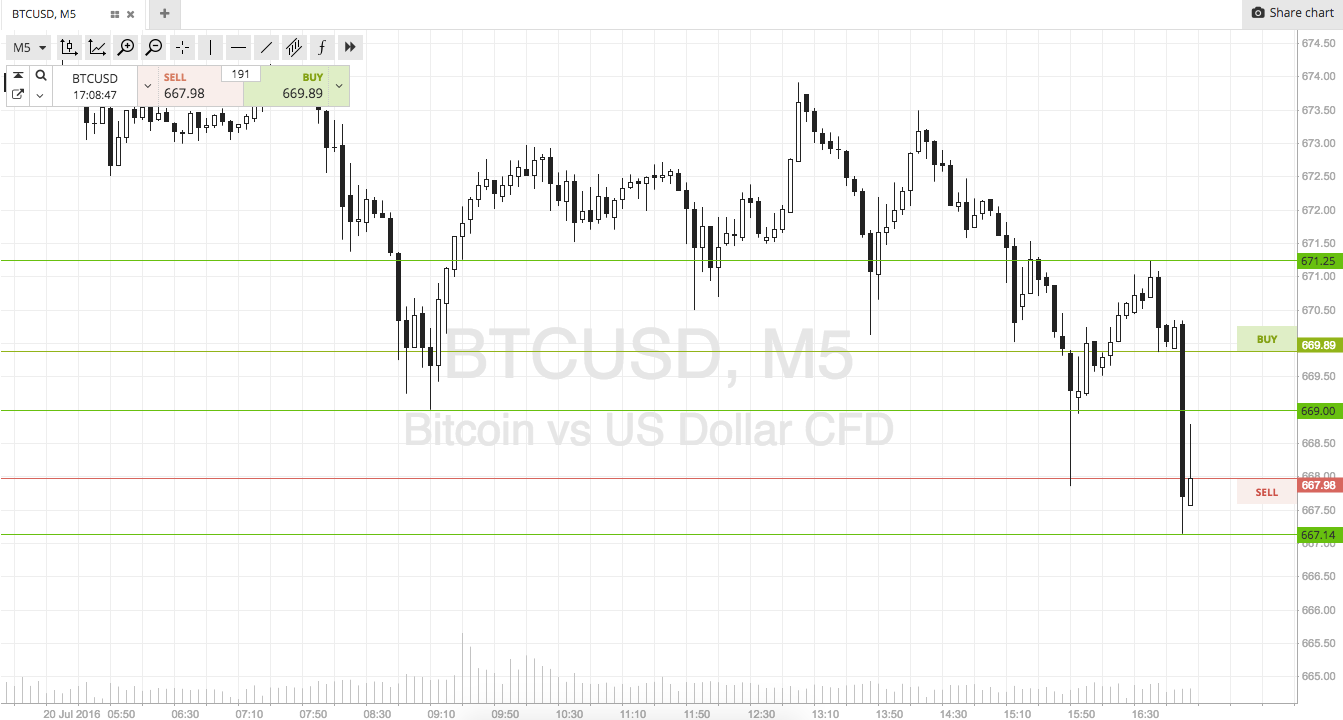

For anyone that is not yet in a trade, however, here’s a look at some of the potential entries heading into the Asian session this evening. Take a look at the chart below to get an idea of our refined range.

As the chart shows, we are focusing on in term support at 667 to the downside and in term resistance to the upside at 671. It’s a pretty tight range, so just breakout tonight. A close above resistance will signal long towards 686. Stop at 669. Conversely, a close below support will put us short towards an immediate downside target of 658.

Charts courtesy of SimpleFX