So that is another day done in our bitcoin price trading efforts and, while we’d love to say that this morning’s thesis was correct and that we have seen a bottoming out of the downside correction, this isn’t looking like it’s the case right now. Price currently trades in and around the $2300 mark, having topped out earlier this week in and around $3000 a piece. That’s a pretty sharp discount, regardless of how high price ran initially, and chances are, as the longer-term operators who might’ve been more open to a little bit of risk early on in the week (that is, those more willing to hold onto their long-term positions as price declines) lean towards risk-off sentiment, and pull their profits off the table, we’re probably going to see further decline heading into this evening’s session.

Nobody can really say when this dip is going to end. We can base action on what we’ve seen in the past and compare charts to a previous run, but in reality, the fundamentals have changed, and that make a comparison to previous activity difficult.

What is keeping us happy, however, is the fact that we have been able to hedge against this decline pretty much all the way down with various breakout entries. As price goes south, we enter in line with the dip and take the step in/step out profits on the volatility.

So, this evening we’re going to try and do just that again.

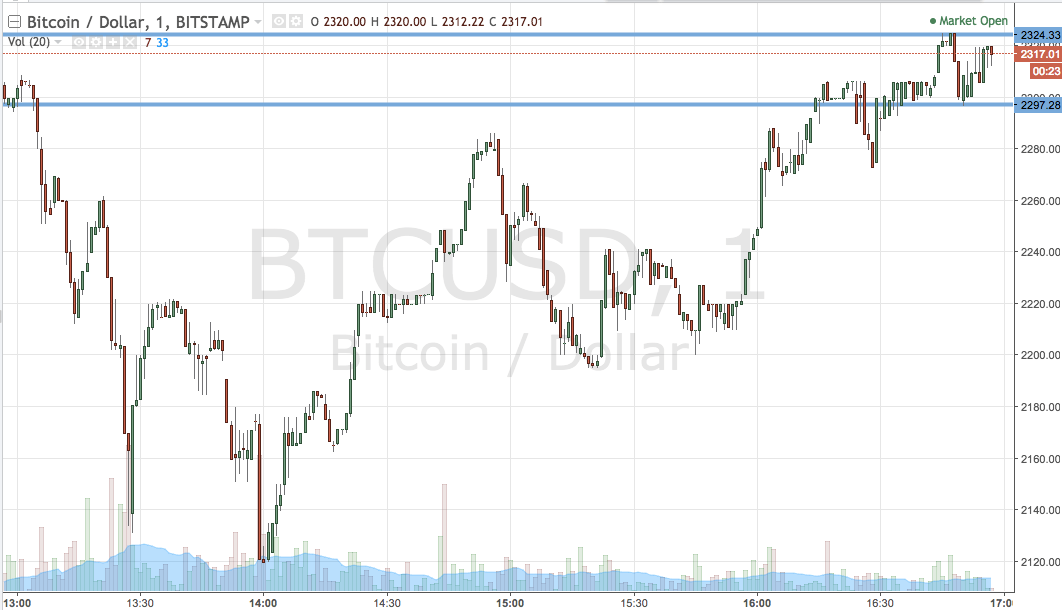

Take a quick look at the chart below.

As the chart shows, the range we are looking at tonight comes in at support defined by 2297 and resistance at 2234. If we see price break above resistance, we will enter towards a relatively conservative upside target of 2255. If we see price break below resistance, which is looking more likely, we will get in short towards 2250.

Let’s see what happens.

Charts courtesy of Trading View

SaveSave