It’s Monday morning, and time to take a look at the bitcoin price for the first time this week. Action was nice and volatile last week, and price gave us plenty of opportunities to get in and out of the markets according to the rules of our standard intraday strategy – in long on a break of resistance and in short on a close below support, with a take profit set somewhere in the region of a two to one risk reward profile. Our intrarange strategy has been put to one side as of late, primarily because the ranges with which we have been trading have been a little too tight to go at with an intrarange system, while still maintaining a positive risk reward profile. This doesn’t mean it’s useless though, and if we get a decent range for today’s session, we’ll go at price accordingly.

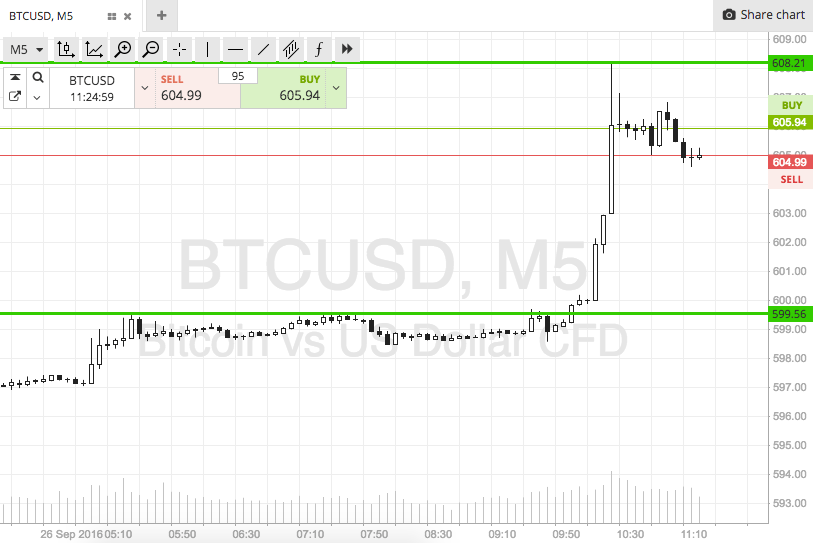

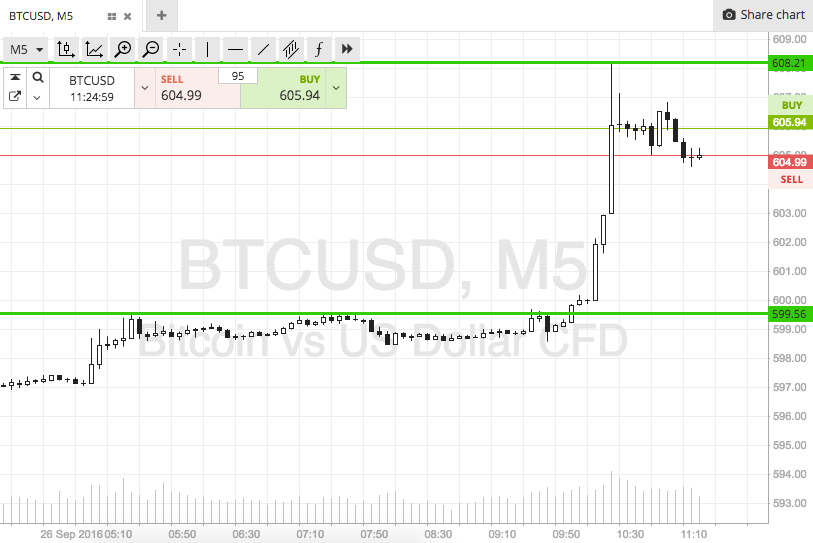

So, with that said, let’s take a look at what we are focusing on right now. Take a quick look at the chart below to get an idea of our primary focus range. It’s an intraday chart with the last twelve hours or so worth of action in the bitcoin price highlighted, and our primary focus range overlaid in green.

As the chart shows, we are targeting a range defined by in term support to the downside at 599 and in term resistance to the upside at 608. Again, and as alluded to already, this range is going to be a little too tight for us to go at the bitcoin price with an intrarange strategy, so we’ll be focusing on our breakout strategy for the session.

Specifically, a close above resistance will put us long towards an immediate upside target of 615. Conversely, a close below support will signal a short entry towards 593 to the downside.

Happy trading!

Charts courtesy of SimpleFX