Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Whatever your political persuasion, last night was a long night, and is likely still continuing for many across the US. Celebrations, commiserations, whatever is in order, we’re going to inject a dose of normality and stability in to your day with the first of our twice daily bitcoin price watch analyses right here.

For those that couldn’t bear to watch, we’re going to spoil it for you now – Trump won. What that means for the bitcoin price remains to be seen. My initial thoughts right off the bat are that we will see some negative sentiment (not towards, Trump, but in terms of risk off exposure reduction in the wider financial markets) and that this could lead to a nice boost for bitcoin. It all depends where the capital flees. If the greenback takes a boost, our intraday trading might be a little tough. If precious metals are the order of the day, BTCUSD should run up concurrently – we normally see a bit of a boost in crypto as gold rises.

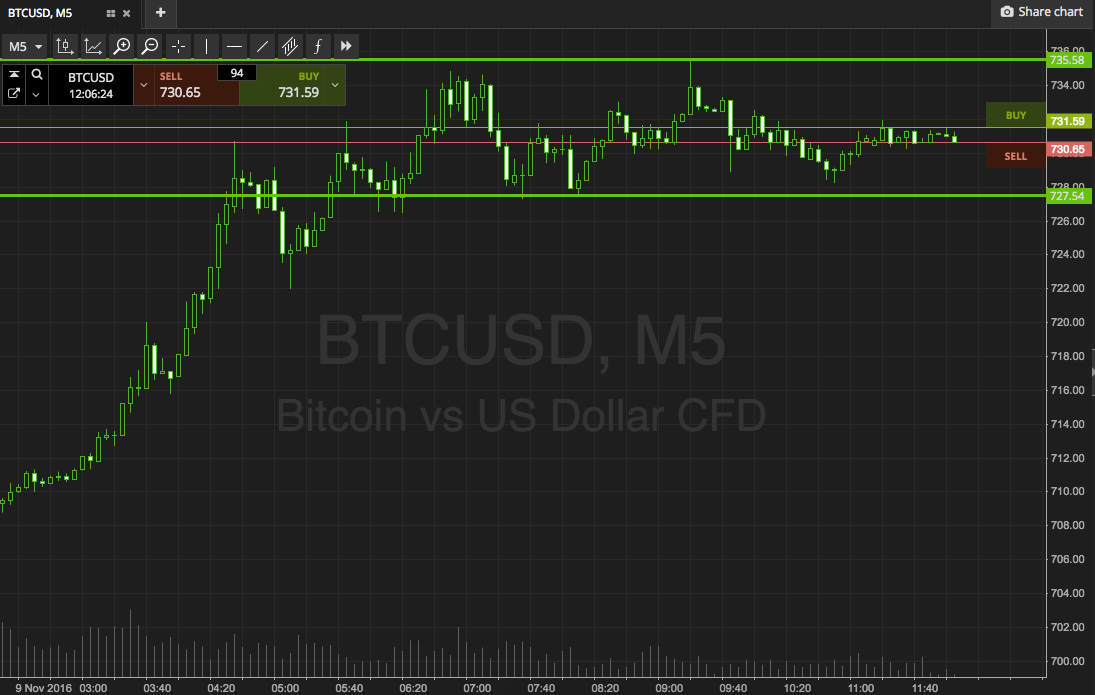

Anyway, whatever happens, we’re going to line up accordingly and take the entries as they come. Take a look at the chart below to get an idea of what’s on, and where we are looking to get in and out of the markets according to our intraday strategy.

As the chart shows, the range in focus is defined by in term support to the downside at 727, and in term resistance to the upside at 735. We’re going for a breakout approach only today, so if we see a close above resistance, we are going to get in long towards an immediate upside target of 740 flat. Quick trade, tight stop, somewhere around 733.

Conversely, a close below support will put us in towards 720. Stop at 730 keeps risk tight on that one.

Charts courtesy of SimpleFX