OK, overnight action was a little strange last night. We saw price break through the level we had predefined as being one to watch in the early evening session, and managed to get in and out of the markets according to our intraday strategy as a result. However shortly after our trade closed out, the bitcoin price took a dive, and gapped down to fresh weekly lows somewhere in the region of 1010, or just a little lower. Just as price started to look as though it was set for a retest of the 1000 flat level, the spike down found a bottom, and price started to recover. This recovery picked up pace towards the end of the night, and as we head into the early morning session out of Europe today, it looks as though we will have plenty to go at.

So, with this in mind, and Bmoving forward into the session, here’s what we are going for right now, and where we are looking to get in and out of the markets according to the rules of our intraday strategy.

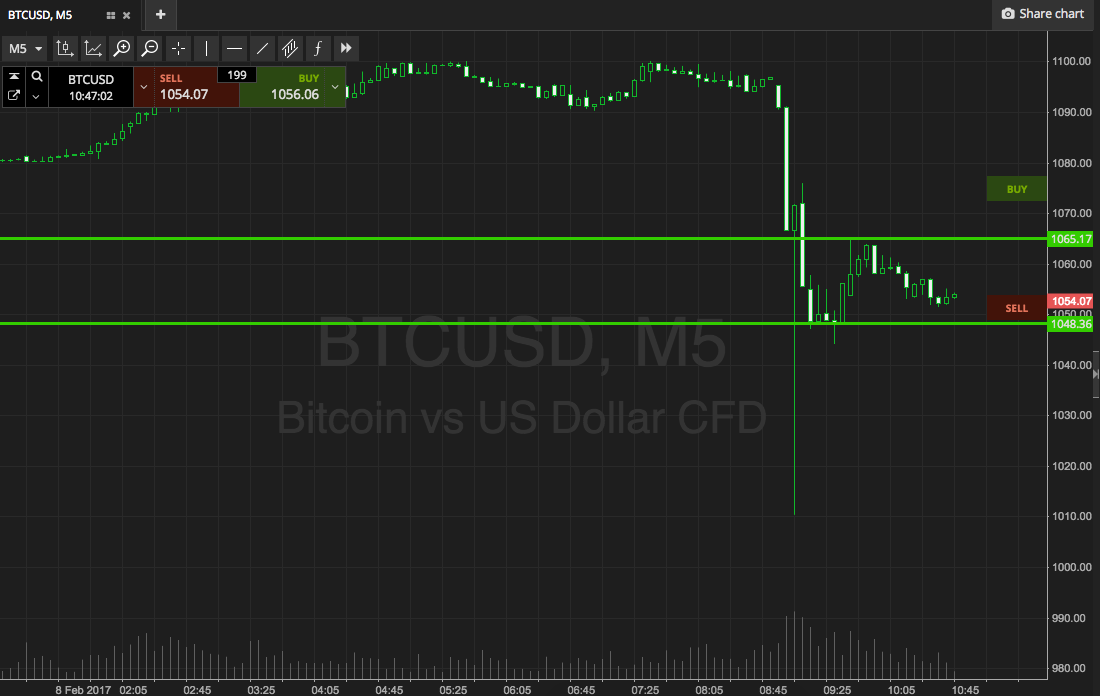

Take a look at the chart below before we get started so as to get an idea of the levels in focus, then we’ll get into the details.

As the chart shows, the range in focus for this morning’s session is defined by support to the downside at 1048, and resistance to the upside at 1065.

If we see price break above resistance, we will look for a close above this level to put us in long towards an immediate upside target of 1075. A stop loss on this one at 1062 defines risk on the position.

Looking short, a close below support will put us in towards 1040 flat. On this one, a stop at 1052 looks good from a risk management perspective.

Charts courtesy of SimpleFX