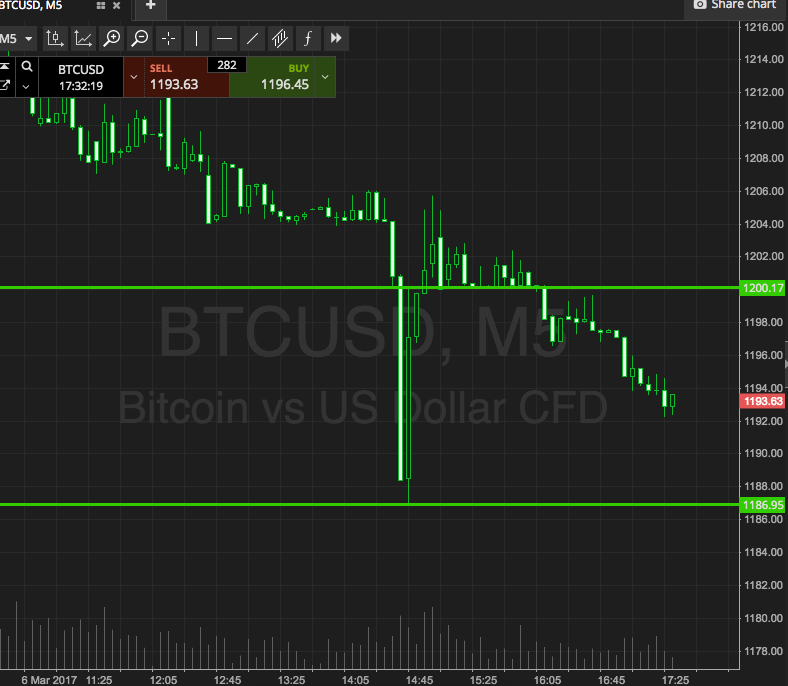

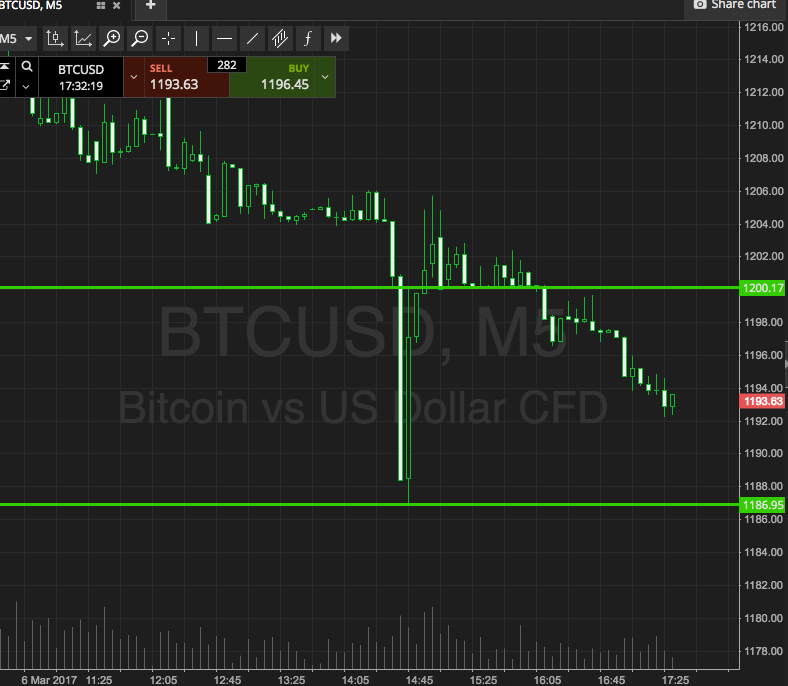

OK then, that’s another day done in the bitcoin price, ad it’s been a pretty interesting one. This morning we noted that we would love to see price hold above the 1200 level, as we thought there was a strong chance that the recent gains were part of a much more stable run than that which saw price run up at the start of the year. The holding of price above 1200 would have validated this suggestion to some degree. With that said, we also set up a downside target, so as to take advantage of any action that went against our overarching bullish bias. As it turns out, we did see a downside break, and 1200 failed to hold. It doesn’t completely invalidate our long term thesis – the fact that price hasn’t spiked through to the downside, and is slowly depreciating, suggests there’s some buy friction below the level in question – but it does mean we are looking at a slightly altered range for this evening’s session out of Europe.

So, with that noted, let’s get some key levels outlined, and see what we can do with our strategy tonight. As usual, take a quick look at the chart before we get started to get an idea od what went on today, and where we are looking right now.

As the chart shows, the range we’ve got for tonight is defined by support to the downside at 1186 and resistance to the upside at 1200. We’re going to limit our entries to the upside for this evening, because the above mentioned friction makes a risk reward profile tough on a downside entry.

So, if we see price break above resistance, we will get in long towards an upside target of 1210. A stop on the trade at 1196 defines our downside risk.

Charts courtesy of SimpleFX