Our analysis of the bitcoin price on an intraday basis is becoming relatively monotonous. We define a range in the morning, look to trade that range throughout the session that follows, be that intrarange or on a breakout strategy, and then evaluate the day’s trading come evening time. This evaluation makes for interesting reading if a) we have some trades to look over and discuss and b) we can use the action seen throughout the day’s session to put together a strategy for the evening’s trading. Unfortunately, for the past week or so, action throughout the day has been pretty much flat. If not flat, then encased by our (already tight) range. Not only does this mean it’s difficult to reevaluate things, as we’ve had no break in the key levels we are looking at, but also it means there’s not much we can base our action on as we haven’t got into any trades. Having said this, this kind of action is key to our strategy. Patience is invaluable when attempting to consistently apply an intraday strategy, and while it would be tempting to hop into the markets without a signal just to see how the trade played out, if there’s nothing to go on then even a profit hit would be luck, not strategy.

With this in mind, and ahead of tonight’s Asian session, we are going to remain steadfast, and hold our levels going forward.

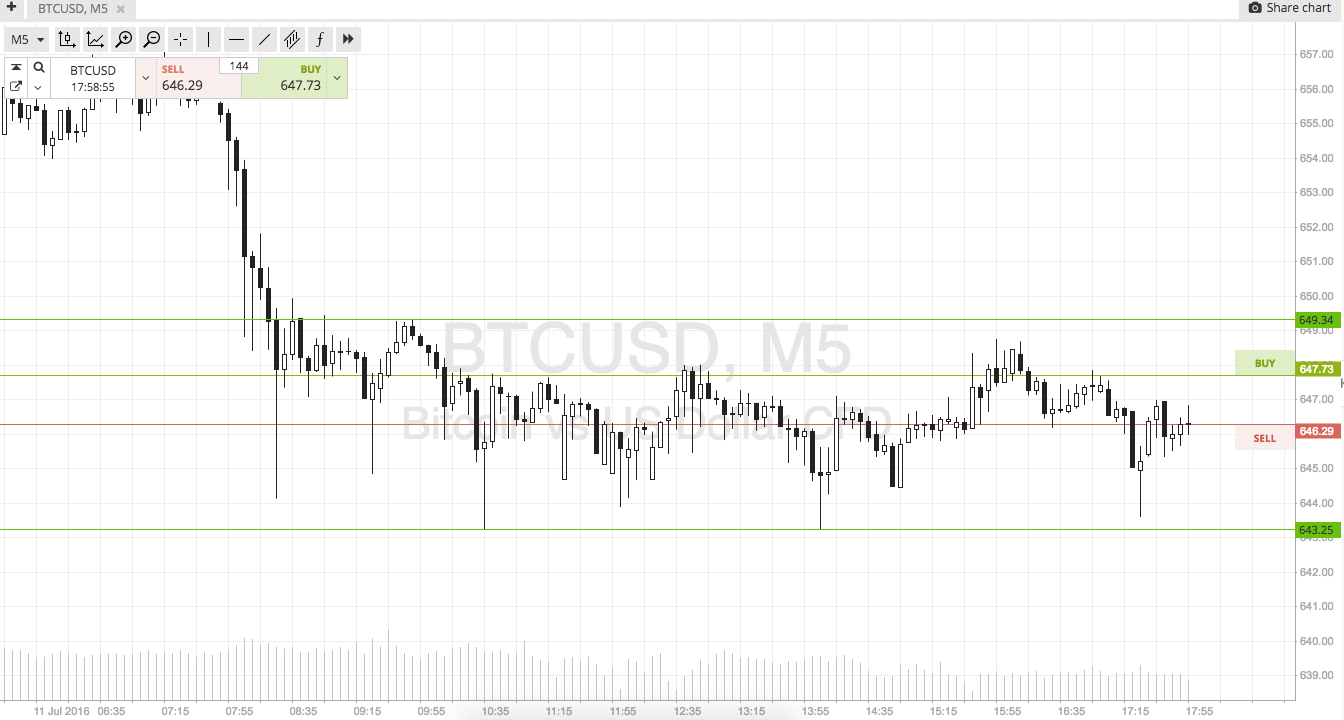

Breakout remains on, with support at 643 and resistance at 649. A close below or above these levels respectively will put us in a trade in line with the break, and we’ll look to target somewhere in the region of $10 reward in both instances. A stop loss around $3 the other side of the close will define risk, and ensure we are taken out of the trade in the event that price reverses and goes against our initial entry bias.

Patient Trading!

Charts courtesy of SimpleFX