As a result of the pretty lackluster bitcoin price action we have seen across the bitcoin markets over the last few days, these analyses are probably getting pretty tedious for some. Indeed, the ability to stay out of the markets and not enter trades based on our standard strategies is similarly tedious. When we entered the week, we did so off the back of some large upside gains initiated over the weekend on high volume. This suggested that we would see a pretty volatile week, and gave us plenty to look forward to as things progressed.

We are now heading into the Thursday morning European session, however, and things haven’t been as active as we’d hoped. Having run up on the back of the aforementioned upside volatility at the beginning of the week, bitcoin price has since declined and traded sideways for pretty much 72 hours, and now remains midrange between a range that we have been looking at pretty much all week. This doesn’t mean that today won’t bring the volatility we need however. So, with this in mind, and with a little bit of patience held, let’s move forward into what we’re focusing on during today’s European session, and see if we can’t draw profit from the market on any volatility as we head into the close of the week.

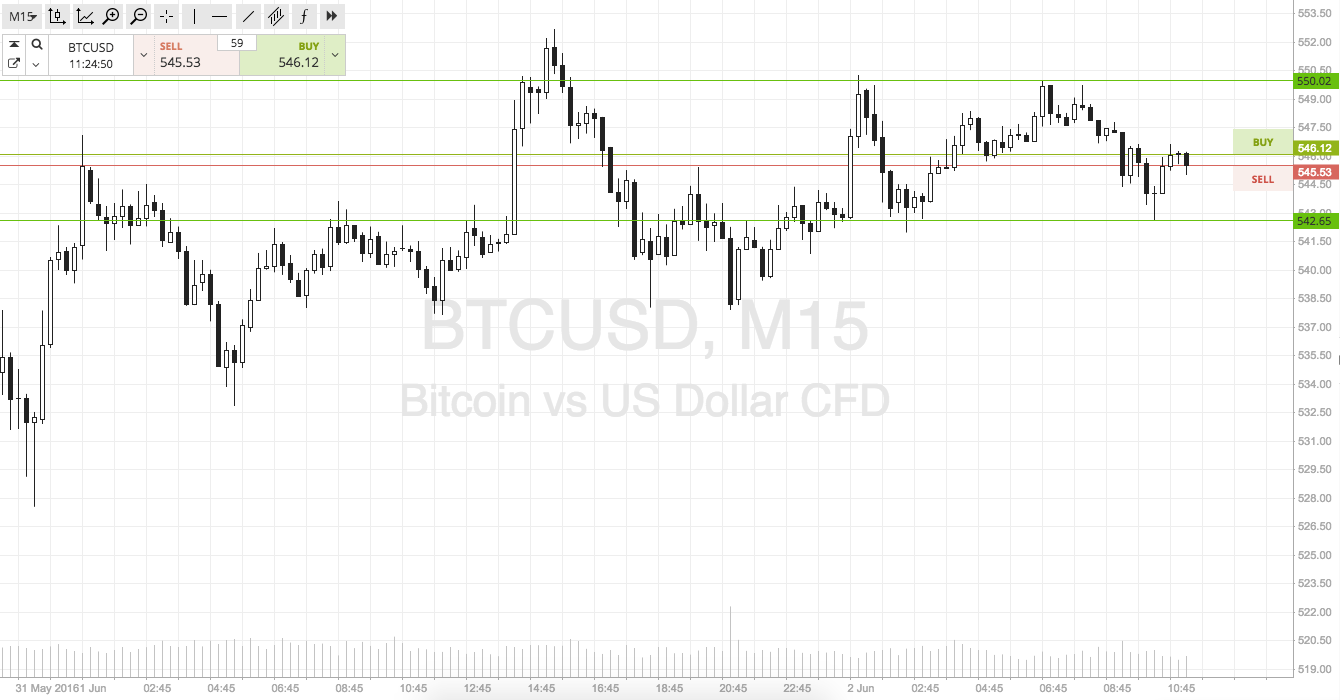

As ever, take a quick look at the chart below to get an idea of the levels that define today’s range. The chart is a 24 hour span 15 minutes’ candle stick time frame chart from the SimpleFX contracts for difference exchange.

At the chart shows, today’s range comes in at support of 542 and resistance of 550. If price closes above 550 we will look to enter long towards an upside target of 560. A stop loss on this one around 547 keeps things tight to the downside. Looking short, if price breaks below support, we will enter towards 534. Stop at 545 to keep things tight.

Charts courtesy of SimpleFX