The weekend is pretty much upon us, and with it, we are drawing to a close yet another week’s worth of action in the bitcoin price, Our trading has been relatively subdued so far, primarily as a result of the lack of any real sustained momentum in the markets throughout the early days of this week. This doesn’t mean we haven’t been able to get into any positions however. Today’s action brought with it some solid upside action, and we were able to get in long a little earlier on this morning (pretty much straight after we published the first of our two bitcoin price watch analyses), and in turn, get out for a nice profit take. Price soared throughout today’s session, and the question now, is whether or not this upside momentum is likely to continue as we head into the weekend. Will we see further upside action? Of course, we don’t know. If we did, things would be easy. What we do know, however, is that we can get in on either side of the market if we set up our key levels correctly.

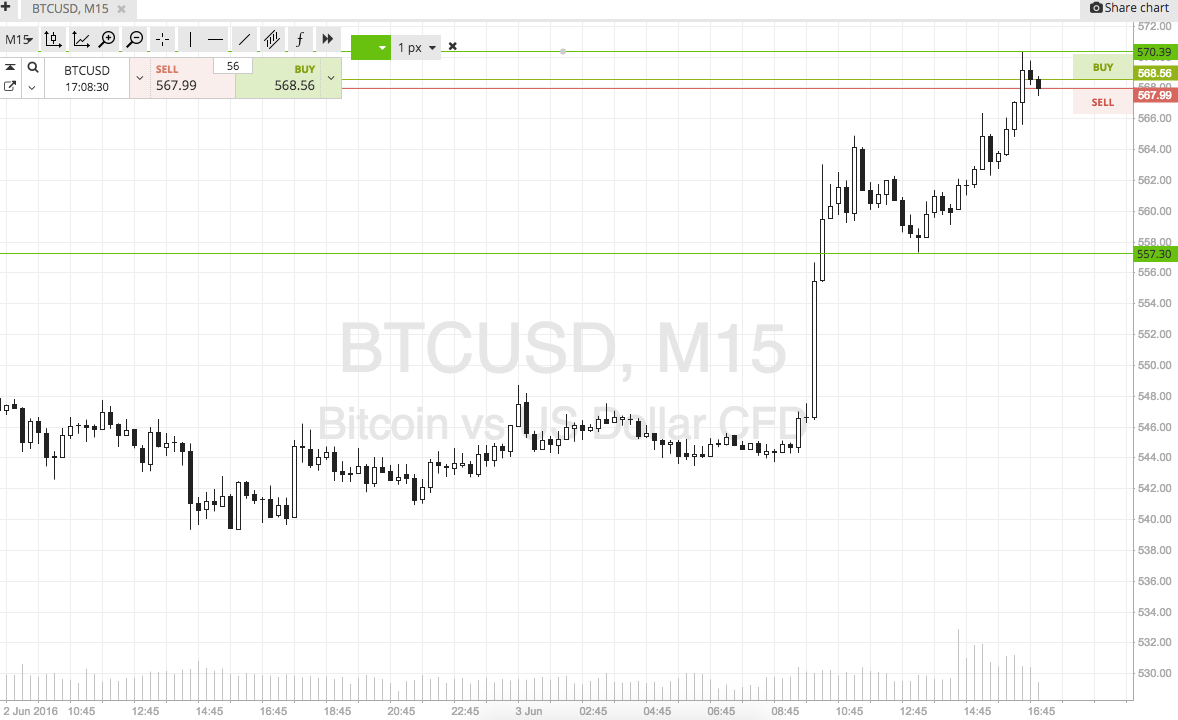

So, with this in mind, here’s a look at how we aim to approach markets this evening, taking into account the day’s action. The chart below shows our evening range highlighted and overlaid onto a fifteen-minute candlestick chart.

As the chart shows, the range on which we are focusing this evening is defined by in term support to the downside at 557 and in term resistance to the upside at 570 flat. It’s pretty wide, so intrarange is an option for the aggressive trader.

For breakouts, long at a close above resistance with a target of 580 flat, stop at 565. Looking short, a downside entry on a close below support and a target at 550 flat looks good.

Charts courtesy of SimpleFX